Around Christmastime, Jesse was chatting with his sister’s husband, Justin, about budgets. They are both what I’d lovingly refer to as “nerds”.

You know the kind of people… those people who think spreadsheets are fun. And who geek out over features in Excel. Yup, those kinds of people.

You might as well poke my eyeballs out with a hot iron rod than get to me be giddy over creating spreadsheets. But nevertheless, I love Spreadsheet Nerds because they help keep people like me in line and on track! 🙂

Anyway, Justin started telling Jesse about YouNeedaBudget (YNAB). We’d both heard of it before had been good with using Quicken for so long that we’d not considered changing to anything else.

Well, when Jesse saw the features of YNAB, he was intrigued enough to sign up for the free trial. And it was pretty much love at first sight.

Truthfully, I can’t even begin to tell you how often I’ve heard him exclaiming to me, to friends, or just to himself something about, “How cool and helpful YNAB is!”

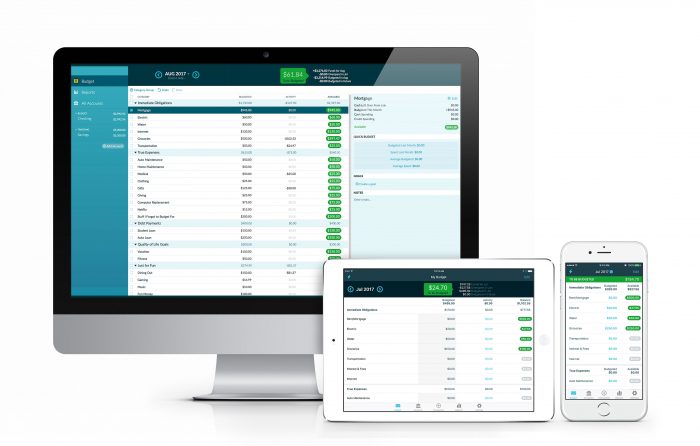

I’m such a pen and paper and cash girl, but after all his raving reviews, I finally gave in and downloaded it on my phone and had him show me how it works. It’s really, really impressive. I’m pretty sure I’ll forever be connected to my green cash, but I love how we can see exactly how we’re doing in every budget in just one glance.

And since we have multiple budgets for our businesses and personal, it allows us to track them all in one app. Which is so handy!

I asked Jesse to share what he loves about YNAB most. Here’s what he said:

- I love having mobile access to my budgets.

- I love being able to access all of my budgets on demand.

- YouNeedABudget makes budgeting easy by assigning each expense to a category and automatically takes it out of the budget when you record the transaction.

- If you record the transaction from your phone using the mobile app, YNAB will update the balance and display the new category balance once the transaction is entered.

- All budgets stay synced on all devices through Dropbox so you always look at the most recent numbers.

- You can easily import transactions at one time from your bank by importing a downloaded statement on your computer.

I asked the folks at YNAB to share what sets their Budgeting Software apart from others out there and here’s what they shared:

1) You only budget money you have right now.

2) It is flexible. Rule Three: Roll with the Punches – removes any shame in overspending in a particular category any given month. It will happen. All the time. That doesn’t make you a failure. Just adjust, address it and move on.

3) There is a manual component. We are asking you to be hands on, to be aware of every dollar, to be involved with your budget. This requires a little bit of time (although once you get used to it, it’s super quick and easy), but this is also why it works. Without awareness nothing will change.

4) We want you to live on last month’s income. Yes, this takes some time to achieve for most people, but once you can do this you will be shocked at how little stress you have about money. Once you live on last month’s income, you’ll never go back!

5) A lot of people think of budgeting as restriction, but what YNAB will give you is control over your finances, and that control translates to freedom.

6) A lot of people come to YNAB because they are drowning in credit card debt or paying overdraft fees every month – and YNAB changes their lives.

7) YNAB has a killer support team and offers free, online daily budgeting classes.

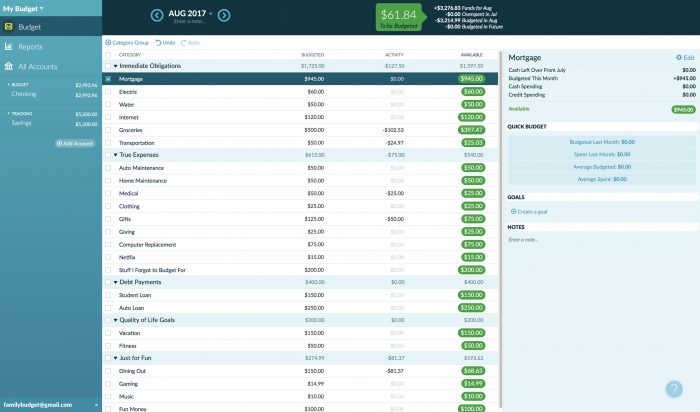

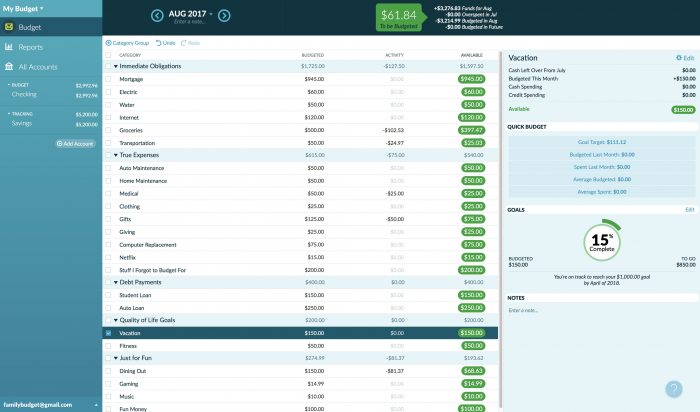

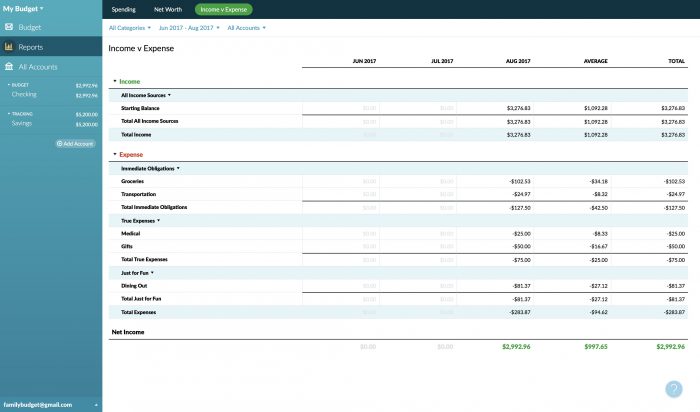

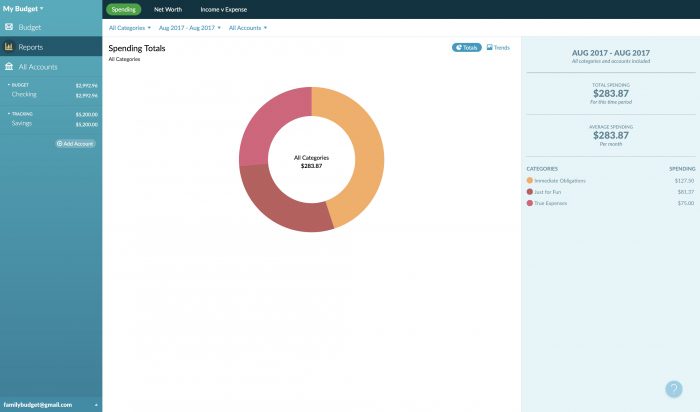

{The four screen grabs above are fictitious examples provided by YNAB.}

Sign Up for a Free Trial

Want to try out YouNeedABudget? Sign up for a free trial here. {Psst! YNAB is free for college students. Details are here.}

Have you used YNAB or another budgeting software before? I’d love to hear about your experiences — both positive or negative.

This post was underwritten by YNAB. We were so happy to share honestly about a product that we’ve found to be a wonderful tool in our home and for our finances. Read my disclosure policy here.

The “Every Dollar” app (by Dave Ramsey) is also a useful tool for budgeting and tracking spending. Best of all it is a FREE tool for the basic app. There is also an upgraded version that links with checking account if you want topay for it.

I tried using YNAB, it could not log into my bank. I am currently using Goodbudget, seems to help me with my budget needs.

Crystal (and other readers),

just wanted to give you all a heads up about some YNAB changes. We use YNAB, and have for a few years now. We use the old version that was a flat one time cost. The new version is now an indefinite monthly charge instead (which some might prefer but would end up costing more in the long run). Also, from what I’ve read about it, the new version does not allow you to carry over a negative balance in a category to the next month. They are trying to encourage wiser planning and spending. The problem some people have with that is, for example if someone has business expenses one month that their employee reimburses them for the following month. They used to be able to carry that negative balance over until they deposited the reimbursement check from their employer but it appears this is no longer an option. There are other situations this would apply to as well, other than just business expenses, depending on your personal budget.

I’ve seen arguments where some say you are still technically spending money you don’t have by doing that and that YNAB is just helping that. Regardless of others feelings about your budgeting though, just know that if you chose to track your expenses this way it doesn’t seem to be an option anymore with the new YNAB.

I’m not sure what other changes have been made to the new version. We already plan to stick with the old version (YNAB 4 I believe) as long as possible so I haven’t looked into the new version in depth.

All that said, I had tried Mint and a few other budgeting tools over the years. YNAB was by far our favorite and pretty much did everything we needed. I love the concept of budgeting a month ahead, planning your expenses for each category and still being able to reconcile transactions through bank import if you missed entering some, and the app is great as well. But I also really loved the fact that it was a one time only cost and that it had the flexibility of temporarily carrying negative balances over if we needed to do so for tracking. So if you are considering it for your budget you may want to check these things out prior to signing up and make sure they won’t be an issue for you. ?

Thanks SO much for sharing this! I really appreciate it!

Will YNAB work when you don’t make the same amount every month? It’s so hard to budget when you don’t know what your income is going to be. We are either feast or famine ( and not really because when when we are feasting that means we are behind because it HAD been famine for too long and have to play catch up. Lol!) I know that if we are able to do it long enough we will be budgeting from the previous month….. That is one of my goals.

YNAB would work well for people who don’t make the same every month because it encourages you to live off last month’s income (money you already have) not your upcoming paychecks (money you don’t really have yet). It is also a great way to budget ahead each month for expenses you’d have trouble paying in your “famine” months. Hope that makes sense!

Hi Crystal, it is December 2015 and I am in my free trial ( I didnt get it through your link though)… I was hesitant to sign up and buy the actual ynab software so I googled money saving mom +YNAB to see if perhaps you mentioned it because, well…I trust your opinion!.. and I found this!!! Alright ynab here we come signing up!

Woohoo!! I hope you love it as much as we have!

somehow I missed the other posts about YNAB. I just signed up for a free trial today and am so excited. As I was watching the tutorial, I felt like hugging them- it is so easy to use and intuitive and I know it will really actually HELP us instead of being another crazy hoop to jump through to keep on track with our dollars. Thanks for the recommendation!

We’ve been using Dave Ramsey’s EveryDollar because of the automatic connection to the bank account feature… I didn’t think YNAB had that (when we used it several years ago, it didn’t automatically connect), but on one of the screen shots it looks like it does connect to your account. Can you import the transactions and then manually categorize them!?

I’ve been using YNAB since Sept 2011. It has revolutionized how we think about and handle money. We’ve never carried credit card debt,; we’ve always been savers. But when we retired, money was a different ballgame. We were afraid to spend a dime.

With YNAB, we can see that we’ve budgeted money for a trip, the property taxes, those inevitable vet bills with an aging pooch. I don’t stress about it because the money is sitting there for that purpose.

The biggest change is that I don’t look at the checking account balance to decide whether we can afford something. I look at the amount in that category. The result is a very nice cushion that has built up in the checking account.

I love the app

We’ve been using YNAB since April and LOVE IT!!!!!!! I had devised a similar system using Quicken and Excel, but it was much more time-consuming. After several months of researching (Goodbudget, Mint, Quicken), I decided to do the trial run and was so happy that I bought it! I actually used Dave Ramsey’s free version of Every Dollar to set up the budget categories and amounts, then transferred everything over to YNAB. It has taken us 24 weeks to fully fund our Buffer, but as of October 1, we will officially begin to live off last month’s paychecks! I am SOOO excited! And we’ve gone from me constantly hassling my hubby for not helping with the finances to us meeting EVERY WEEK to decide together how to fund our accounts. We are now working as a team, and are making progress in saving for the 3-6 months emergency fund. It took forever to have the courage to try something new, and I’m very thankful that YNAB has been such an outstanding solution.

What is the cost after the free 30 day trial?

I haven’t heard of this tool until now. We’ve been using Dave Ramsey’s every dollar budget/app and are loving it…especially that it’s free! 🙂

We have been using Mvelopes for several years now, and love it. It sounds very similar to YNAB except it is liked to your accounts which is very nice. We also have only used the free version and it does everything we need it to do.

I wanted to sign up for the Free Trial but when I follow the link it goes straight to downloading the software then asks for an “activation key”. Am I missing where the activation key is located? Thanks!

YNAB user for 4+ years! I believe it is totally worth the cost. It works the way my brain works and how I wished Quicken would work.

We are doing the Dave Ramsey program currently. Would this work well with it ? I know that sounds like a dumb question, but sometimes things have different philosophies and just don’t work well together. Just curious since the every dollar budget app confuses me a little. Thanks

Absolutely! Think of ynab as your electronic “cash only” system. When you put your money into the different categories think of it like putting your cash in an envelope. You put $60 in the grocery category and when you are in the grocery store you look at your category balance of $60 and not your bank account balance of $200. When you go to the store you take whatever you spent out of the grocery category and you can see what you have left. It helps make spending decisions easy. If I’m thinking of having a deluxe nacho night for dinner (think all the works, easily $30) I look at my budget and see I only have $60 in groceries for the week. I don’t want to take money from any other categories just to make my mouth extra happy so I settle for every day tacos for $5, end up just as full and happy and with more money in my “pocket”.

If you had a tire blow out before you had your emergency fund in place with cash only you’d have to pull cash out of one of your other envelopes to cover replacing the tire, same thing in ynab. If you have an emergency or expense you didn’t budget for you can pull money from one of your other categories.

As an impulse shopper I have gone from having $2 in my account before payday to having a couple of hundred sitting calmly in their categories waiting for their time to go to work. It’s not quite the dramatic success story that other people have but for me it’s huge!

Also if you take the free classes they often give away a copy of the software. It’s really fantastic.

Yes. YNAB is the perfect match with Dave Ramsey. You can do a free trial for 34 days. Also, they teach classes that you can sign up and take. We got a free subscription for our college daughter and then got a free trial for us. We liked it so much better than anything else that we’ve done. They give away a free software with each class. During our trial period, we won a free software program with a class we attended.

However, I believe that it’s worth every penny. (We had spent years using Quicken–but YNAB is light years ahead of Quicken.)

Another vote for Mint…it does the same stuff but is FREE. Here is a discussion comparing YNAB and Mint. Mint is more tracking and “how are you doing on the budget you set”; I don’t have experience with YNAB since I don’t want to spend money just to see where my money goes!

I politely disagree here – Mint doesn’t do the same stuff as ynab at all! I am an avid Mint user since it first came out many many years ago, and I’ve been using ynab for about three months now. I can’t even begin to explain how the mental philosophy of ynab and mint are so wildly different. It’s like yin and yang. YNAB helps me with my impulse shopping by keeping my priorities in perspective in a way that Mint didn’t work for me. I’m also not naturally good with my money – and YNAB speaks to me in that way. I also very very happily paid for the program after using it for the trial, because I believe in compensating people for their hard work and ingenuity. I like their plan, program and I support them.

YNABer since May 2014…. been making steady progress every month since.

We have been using mint.com for the last several years, and my husband and I both love it, and it’s nice that it’s free. It automatically syncs with bank accounts and credit card accounts, you can save up money in budgets to pay for once-a-year type expenses, and you can easily split transactions. Can anyone comment as to the differences between Mint and YNAB? I am very happy with Mint, but now I am curious about YNAB.

I used Mint and also different bank websites.

Mint isn’t forward looking, it shows you what you spent which doesn’t do anything before you spend it. YNAB forces you to look forward and plan for expenses and prioritize short and long term goals.

My car repair category bailed me out 4 times in my year+ of YNAB…

Paid off about 3k of debt and my net work went from -10k to -4k all while my life is very complicated right now…when life gets less complicated I’ll pay off my remaining 8k in no time. Ynab helps you set a line between old spending and new. You only use cash and money already earned to budget…not expected money. So you end the credit card float. At first it is a rude awakening.

I, too, tried Mint before switching to YNAB. I love YNAB because it’s so flexible and I’m able to see exactly where my money is.

Here’s a link to a blog post at Six Figures Under that compares Mint and YNAB:

http://www.sixfiguresunder.com/best-thing-budget-mint-to-ynab/

We used Mint for years before finding YNAB. There were some things that really frustrated me about Mint and YNAB solved all of those problems (and more) for us. I wrote about why we switched from Mint to YNAB here: http://www.sixfiguresunder.com/best-thing-budget-mint-to-ynab/

I love YNAB! The online classes are so helpful. Also, I’m addicted to my credit card rewards, but thanks to YNAB, every penny of my credit card expenses comes out of the budget.

I started using it a month ago when you mentioned that Jesse loved it. It makes me giddy. : ) When I was gushing about it to one friend, she laughed at me and said it’s my form of gaming. It has made budgeting and reconciling easy and efficient! Thank you, Jesse.

This cracks me up so much… you and Jesse would get along so well!

We have been using YNAB for years now, and LOVE it! We recommend it to everyone we know…especially those who don’t love carrying cash. I was pleased as punch to see you sharing about it on your blog…tell the world!!!

I don’t know if they’re still doing it, but it used to be free for a year for full time students.

http://www.youneedabudget.com/blog/2014/ynab-is-now-free-for-college-students/

Yes it still is free for college students. All you have to do is call them to let them know you are a college student. They request you have a valid .edu email address and proof of class registration. As long as you update them each year it is free for all of your college career. Our daughter is on her 3rd year of using YNAB (2nd as a college student) and absolutely loves it!

If you would like to purchase YNAB, this is a link for 10% off. It takes it from $60 to $54. It will be the best $54 you have ever spent!

http://ynab.refr.cc/2P5BNJM

Is the $54 a one-time expense or yearly expense? Thanks.

We LOVE YNAB. We started using it about one year ago and now we cannot imagine our lives without it. After many many failed attempts with other budgeting systems, it finally “clicked” with YNAB. It teaches you to really think about every penny you spend and requires you to have discipline (while still allowing you to use your debit and credit cards!). We have had a few life catastrophes in the past year that put is in the red, but we stuck with YNAB and still tracked every purchase. It helped us bounce back in no time.

I budget to a T . I use my calander to write everything down . I will try this method too . Thanks

We’ve been using YNAB for 2 years and I love it so much! My husband is definitely a spreadsheet nerd. He works in finance and has crazy Excel spreadsheets for everything. We were doing well with budgeting but I wanted to be more involved with tracking our finances and signed up for the free trial because his Excel sheets were overwhelming. In my head, I was always worried about upcoming expenses/emergency funds and I couldn’t get my mind around the one lump sum of money that was the bottom line of his budget. In YNAB you can create categories for as many or as few things as you want, so I made categories for all the big ticket items I would worry about how we would cover the cost when we need to repair or replace things. We allocate a certain amount of money toward each category every month as sinking funds. It also took away my guilt about spending money for ‘fun’ things (vacations, gifts, etc) when I know I have a certain amount of money available in that category to spend, versus feeling like I needed to save all of my money for emergency expenses because I felt like we would never have enough. You’ve always posted about goal setting and a couple of years ago I decided to try setting yearly family goals. It has been amazing to see how we have surpassed our financial goals every year since using YNAB. I also love that we have been using YNAB to have ongoing discussions about how we are allocating our income, what our priorities are, and if we want or need to change our priorities it is easy to do with this software. I cannot say enough great things about YNAB and I’m happy you like it as well!

Question…Can you split transactions? I have tried several electronic types of budgeting software and apps but end up bailing on them and going back to our paper Budget binder because I can easily split a transaction. What I mean is say I go to Walmart…I buy food…food budget…printer ink…school supply budget….oil for truck…car repair fund…and a new top for me…personal money …But I buy them all on one receipt. With my money binder I can easily split up this transaction but have never found software or apps that can let me do that with ease.

Yes, you can split transactions in YNAB 🙂

I haven’t used YNAB personally, but I can totally relate to what you said about spreadsheets. I don’t love them at all and avoid them at all costs! Budgeting has always seemed like a drag to me, but being in debt is even worse. It has been very important to me to find a way to set financial goals by figuring out how I’m spending my money and where I can save. Setting up a spreadsheet and working in it regularly is the last thing I want to do. That is why using a program where everything is already set up for me is so appealing. There are a ton of apps and programs out there (I’ve tried several). Trying different ones out has really helped me streamline my families budget and helped get things in check. The great thing is now there are banks and credit unions that understand people want to use technology to get their families on track and are offering these financial tools to their customers. What is great about some of these Personal Financial Management (PFM) platforms is that you can link all of your financial institutions and even link to retirement accounts so it gives you a full picture of your financial health. PFM actually integrates into online banking through companies like Geezeo, so the chore of managing money is reduced. Saving money and time, is a good thing for a full-time working mom!

11+ years ago my husband wrote a program that could be a twin to YNAB. Life got busy. He was working a ton and we had 3 kids 3 years old and under. He handed over finances to me. I used pen and paper. :/ All that to say, 11 years later, he found YNAB and feel in love with it and begged me to use it. So, I humbled myself and figured it out. It’s rather easy to use. We’ve used it about 6+ months. We sometimes forget to write in our purchases, but overall, it’s easy to reconcile with your bank and move around money through the budget as needed. For example, we set aside money in a ‘saving for couch’ category and then our dog broke her arm and we had to pay for surgery. We moved our ‘couch money’ into our ‘Pet supplies’ category. Now, we will start over to save for a couch, but at least the hefty Vet bills were paid in full.

One more thing, we have ‘life insurance’ and ‘car registration’ categories. It’s a once a year payment that we broke down into 12 months and so we set money aside each months to compensate. When they are due, we have the money in our account to pay for them. It’s pretty cool to see it add up.

Another great free option is Goodbudget (goodbudget.com). It works just like the envelope system in that you set up your electronic envelopes and then deduct money as you spend it. It does sync to other mobile devices and to your computer. It has been great to keep my husband and me on track and up to date. I love that it’s free (for the basic 20 envelopes) and that I didn’t have to link it to any bank account. It has been a perfect, easy option for us!

Thanks so much for the recommendation!

My husband and I started YNAB about two months ago. We are really liking it so far. Although we had a budget, we would often overspend without realizing it (since were not using the envelope system). This has helped us to acknowledge what our budget figures are as well as keeping our spending on track. I used to spend every week leading up to payday wondering if I needed to transfer money from savings into checking to cover a bill. Now I can clearly see what bills still have to be paid and can rest assured that the money is in the bank.

Mvelopes is an excellent budgeting software. My husband and I use it as well and both of my teenage boys. It can be used on our computer as well as or smart phones.

I love YNAB! I tried the cash system many many times but I just couldn’t make it work. Cash was always going somewhere it didn’t belong or transactions would get neglected until I was hopelessly behind.

YNAB is my electronic cash system. It’s the same principle. The categories are your envelopes, the budgeted amount your cash. Once that particular category runs out it’s over until you fill it back up.

It is flexible, you can adjust your categories at any time to match your reality but the awesome thing is that if I neglect to track 4 transactions from last Tuesday I can pull up my bank statement and add them in when I realize what I’ve done. With cash if I didn’t hang on to the receipt I was just lost.

Also it comes with a free 34 day trial. You won’t regret it. Take the free classes, learn how it work, go forth and be awesome!

We’ve been using YNAB for several months now and I’ve been singing it’s praises. For us the big things is it really helps encourage financial communication, which had always been an issue with us, and the whole “budget only what you have” principle helped us actually budget for the first time ever. We never could before because our income does not match our expenses no matter how much we cut, so we couldn’t write out a budget to begin with. Now, yes we still have income issues, but we have a much better grasp on our finances, and as we find extra income we are able to use it in a more intentional way.

Joy,

I agree with your state that “financial communication has always been an issue with us.” Crystal, if you haven’t done so already a post on financial communication (a step by step on how couples can be more affective at it) would be helpful. Maybe a guest post from a writer who she and her spouse started off bad at it, and her “how to” that explains how they got better at it. I suggest another writer because it seems that financial communication has always been a strong suit for you and Jesse. You headed into your marriage with a financial game plan. What I need is to hear from a couple who stunk at it at the start and how they got better.

p.s. If a similar post already exists, please share a post.

LOVE IT! We’ve been using it for years with excellent success!

I’m an accountant, but one that, until the last year, didn’t have a budget for home. It got to a stage where I realised our household finances were leaking money.

I did the trial period of YNAB and then promptly bought it. It has literally turned our finances around. We’re now saving money for upcoming expenses as well as for future “wants”.

If you are interested, use the link below to get a discount on the full price of the software.

http://www.youneedabudget.com/?aic=H795RL3

YNAB is the bomb! If you are on the fence, try it. We’ve been using it almost a year and so much stress about infrequent bills is relieved. Once a category is empty, no more spending. Or if there is spending you are immediately aware adjustments need to be made.

By far my favorite thing to play with on my computer.

My wife and I have been using Mvelopes (Mvelopes.com) for over a decade, literally! It’s basically the same as YNAB, only it connects to your bank(s) to automatically download the transactions. Then you simply assign them to the respective budget category/-ies (they’re called envelopes in reference to the budget style, as is the name of the app).

As for Jennifer’s comment about not having a surplus that large, she’s not alone: most people, especially those just starting out budgeting, don’t. But you make that a budget category/envelope and you save up over time until you DO have enough. Depends on many factors (e.g.- amount of debt, income and willingness to cut back lifestyle — at least for the short term), but you would be surprised how quickly you can build that fund once you start truly living off a written budget. Their point #5 is so true! (That’s living off a written budget: whether it’s YNAB, Mvelopes or even pen & paper.)

Budgeting is a way of life, it’s not just something you do “until”. And it can rock your world!

This is so intriguing. I can’t wait to check it out. And, it is so awesome that our crazy life with a family of nine and a husband who is working full-time while also in nursing school pays off if this is free for college students! I knew this whole college in your 40s thing would payoff somehow 😉

We have been using YNAB for over 5 years and love it! YNAB and moneysavingmom have helped our finances more than anything else has. It can take awhile to save up enough to live on last month’s income, but it is so freeing when you get there. You can then decide how you are going to spend your money for the month even if your income varies from month to month. We love looking ahead instead of always looking behind us. Living on last month’s income also serves as an extra emergency fund.

I just might have to try this. I’ve been a faithful Quicken user for many, many years and was excited when they finally got their mobile features working like I wanted, but Quicken’s budgeting features seem to have gotten harder to use over the years. I feel like Quicken functions from a fairly reactive position, and I like to be proactive with our money.

Is YNAB strictly a budgeting software or does it also do things like account reconciliation?

Also, do you use other software (like Quickbooks) for your business financials along with YNAB? Do they sync? If not, is there much duplicate work to keep them current?

YNAB does have a reconciliation feature.

I hate Quicken’s new budget feature. I have a hard time understanding it and difficulty controlling it.

Regarding account reconciliation, YNAB doesn’t automatically update your accounts (like you get with Mint.com) because your accounts are not linked to the software, but there is an option to import data from your bank and various accounts. This is more of a function to let you double check your entries and make sure everything matches up. YNAB encourages that proactivity you mentioned in that you’re manually entering in your spending so that you’re more aware of what’s going where.

We moved from Quicken to YNAB about three years ago. I would never go back because I like YNABs proactive budget instead of reactive budget. Please watch the videos and understand how YNAB works. I jumped in too quickly and thought I could figure it out only to be frustrated for months unnecessarily.

My husband misses some of the tax reports from Quicken, but we’ve figured most of that out now.

We’ve been able to keep on a monthly budget very easily and save up for bigger purchases.

We’ve been using YNAB for probably two years now and have loved it from the start – can’t say enough good about it!

I’ve heard of this before, but never looked in to it. How does living on last month’s paycheck work? I don’t understand how we could do that. Am I missing something? We try to save money each month, but don’t have a surplus that large…

You do need to work towards building that “buffer” of a month’s expenses so you can follow that rule. There is so much help on the YNAB site, though, and so many people who want to help and who believe in the program, that it is so easy to learn.

Basically, you save up one month’s worth of expenses and switch from living paycheck to paycheck to living on a month’s worth of money at a time.

If you’re living paycheck to paycheck, you’ll need to go into the budget each time you get paid and budget (plan for) the new money you just got. You’ll need to figure out what bills are due between now and the next paycheck and make sure you budget for them. How much will you need for groceries? Gas? How much can you put aside for bills that are two, three, four paychecks away?

Once you’re buffered, though, you just mark checks for “next month” and YNAB automatically makes the money available to budget in the next month. You keep living off money you already had, and the new income waits for the month to end before you budget it for the next month. Your focus shifts from the income cycle to the expense cycle (since most bills are monthly), and managing money becomes SOOOOO much simpler.

Getting your buffer (a month of income) set aside happens dollar by dollar. I still haven’t gotten my buffer built up but this software saves my meager savings from impulse shopping every single week! I’ve gone from having $2 on the Wednesday before payday to having a couple hundred sitting in their designated categories. It’s a total game changer.

Like Ashley said above, one of the goals YNAB urges you to reach is to have a one month’s buffer set aside. This isn’t something most people will have right away, but the idea is to save little by little until you get to that point, even if it takes a long time to get there. Since you’re already saving some money month to month, this will help you have a specific goal for those funds and assign them to a “buffer” category until you have enough to be one month ahead. It’s been *such* game changer for my me and my husband.

It does take a conscious effort to save up a month’s expenses to start living on last month’s income, but when you are there it is glorious to be a month ahead! In the mean time, budgeting according to YNAB’s method (only budgeting the money you *actually* have, not the money you *expect* to have) is really eye-opening and will really help you work toward a buffer of a month’s expenses. YNAB is fabulous even if you aren’t a month ahead yet.

I wrote specifically about living on last month’s income (and why we love it) here: http://www.sixfiguresunder.com/living-on-last-months-income/

Sign up for the he free webinars they offer on their website, they are great. The getting started one talks about living on last months income. It’s pretty amazing

We have been using YNAB for about 6 years now. It has literally changed our life and our marriage for the better!

We’ve been using YNAB for a year, and it’s been SO good for our marriage. We have a weekly money meeting where we check in on our goals, see what needs to be adjusted for the month (we decide together!), and talk about any upcoming big expenses. This is also the first time that we had money specifically set aside for our “big” every-six-months insurance payment, and didn’t have to take the money out of our long term savings. Both my husband and I <3 YNAB.

I signed up for the free trial a year or two ago, didnt keep it. This post has made me want to try again.

We have been paying down debt, and paid off 2 credit cards and a furniture loan, but I need more help.

Thanks