Guest Post by Amber from The Hormonal Housewife

My husband and I were looking for a larger home for our growing family. We crunched the numbers and knew exactly how much our mortgage could be without piling on more debt. We spent time looking at homes in our area and were even considering building if we could do so on our budget.

This quest is how we ended up at a regional builder’s model home display. After explaining the building process to us, the agent told us that the overall price of the home wasn’t important; the only thing that mattered is the monthly payment. That’s when we knew we were in the wrong place.

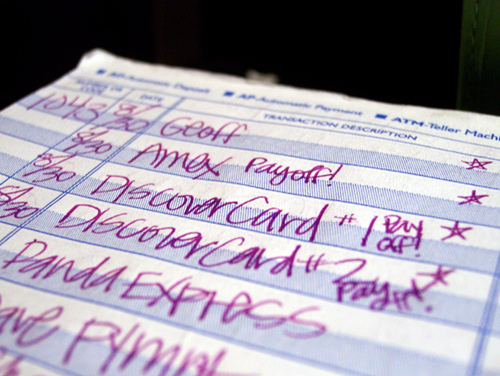

You see, my husband and I have $35,000 in debt. How did we accumulate so much? The answer is simple: one payment at a time.

The scary truth is that the last time we financed a car, we weren’t even sure afterward how much the car itself cost us; we only knew how much we were paying for it each month. Scarier still—we don’t even own that car anymore.

We have three children now and the car couldn’t hold three car seats. We sold the car and used that money to buy a semi-dependable van. Unfortunately, we’re still making payments on a car we no longer have and we don’t even know how much it really cost in the first place.

All of our debt happened in a similar way: we financed something because even though we couldn’t afford to purchase the item, we could afford the monthly payments. My family could never file for bankruptcy even if we wanted to because we can still make every payment.

We struggle to buy clothing and pay for haircuts but we can still make all those payments for so many things we no longer have or are unable to use. Isn’t that sad?

As a couple, my husband and I are determined from now on that we will only buy things we can completely afford instead of making payments we think we can afford. Admitting to the world that we have so much debt because we made poor decisions is embarrassing. The reason we do tell others is because we are passionate about spreading the truth that monthly payments led us deep into debt.

We are working hard to become good stewards of the money with which we’ve been blessed by doing things like using cash and searching for deals on sites like Money Saving Mom. We hope to help others do the same.

Amber Clark is a former English teacher who is now the proud mother of three beautiful children. She is the author of The Hormonal Housewife and hopes to use her blog to encourage women to be better wives, mothers, and home managers.

photo credit: LemonJenny

Thank you so much for your words of wisdom. My husband and I are also deeply in debt, and with the poor economy my husband’s business is barely scraping by and now when I think of all the monthly payments I can’t believe how much we are spending just for that. I try to look back and thank about how we got to where we are and I can’t target a specific problem, just several mistakes that we made along the way. Hopefully we will be blessed to remember this lesson and always strive to live within what we are making.

Thank you for this post! My husband and I claimed bankruptcy several years ago thinking it would help us. Unfortunately, just the opposite happened and the worry deepened and magnified! Hopefully people will read your post and realize they are not alone and can get out of debt, or more importantly, avoid it.

Amber,

Thank you so much for sharing! I’ve gotten myself into financial messes before, and I know they were the last things I wanted to tell anyone!

first: kudos for being so brave and sharing your story!

second: this is exactly why we backed out of buying a new house last summer. we *technically* could afford the payments, but we kept telling ourselves, how can we possibly afford a house for this much? we couldn’t. and i am SO VERY THANKFUL that we made the decision to stop back and stay put and save until we can REALLY afford a new house!!

Amber,

Very proud of you for writing your story. Debt is an easy thing to deny and admitting you have a problem is a huge step towards making efforts to eliminate it. From all the comments, it’s obvious your story resonates with others and is inspiring. As a former financial counselor, I’ve seen many people struggle with finances and it always breaks my heart when people work so hard for so long just to pay off old debts. When I married my husband he had close to $20,000 in debt and through careful budgeting we payed it off in about four years.

Let me also add that not all debt is bad. If your debt is making you money (think real estate, business) it is actually beneficial. The problem really is consumer credit card debt: financing items that are ‘consumed’ by the user and have little to no resale value.

Another note for large purchases: an affordable home should be no more than 3x your annual household income. Your car should be no more than 1/3 your annual income. For example, if you make $30,000, your home should be no more than $90,000 and your car should cost no more than $10,000. This is just a guideline, but is a good place to start when deciding how much to spend. The banks will generally finance way more than you can actually afford to spend for a monthly payment. Also, read the fine print on all financial contracts. If you don’t understand them, ask someone who does to help you out.

Thanks again for sharing your story.

Amber, thanks for being brave enough to share your story. More people need to hear about the trap of “low monthly payments” before they get sucked in. When we bought our 1st house the mortgage officer gave us an analysis of what we could “afford” based on the numbers we had provided- it was about twice as much as what we had already decided was right for us!

Good for you! We are currently saving up to pay cash for a new to us vehicle as ours is dying. We are determined not to get caught in that monthly payment! We did just buy a house using a mortgage, but for us it was the right decision and we did not make the purchase based on the monthly payment! I often wish I had caught on to this mentality much earlier in life.

Wow! I am so humbled by all of your comments. I so wish that I had the time to respond to each and every one. This is what is so awesome about the blogging community–women who might never meet otherwise are given the opportunity to share and care for so many.

Hubby and I are debt free except our Mortgage and building savings and retirement…thanks to Dave Ramsey!! http://www.daveramsey.com It is the BEST FEELING EVER!!

Great post Amber!

My husband and I are fortunate to be debt free, less our mortgage. We recently had a set back and found out my truck needed a new engine. After weighing the pros and cons, we decided to pay for the new engine. It made more sense to get the truck fixed. It’s paid off, and we wouldn’t be stuck with car payments if I had gotten a new vehicle. Some of my friends thought we were nuts, it works for us. That is all that matters. 🙂

@Denise C.,

I’ll add that when I was 17 I got my first credit card. I was very good with it for the first 6-7 months. Only using it sparingly, charging no more than $30.

Then when I was around 22 I had 5-6 credit cards. I was in debt around $5,000.00.

I was in a new relationship and my better half was my high school sweetheart.

He helped me figure out how to pay off the debt on my own. It took about 2 years of throwing most of my paychecks at the credit cards, but so worth it. I remember the last check I wrote to make my final payment to Visa. What a great feeling!

These days, my husband (same guy above) and I have 2 credit cards. They are used for dire emergencies only. We were fortunate enough to have my massive car repair bill in savings. Best of luck to you! 😉

Great post Amber! Please don’t feel embarrassed, by sharing your story you are making many of us feel less alone. My current financial situation is a tough one and it sometimes leaves me feeling frustrated and sad. However, I am learning so much about humility and patience. Stay strong and thanks everyone for sharing their stories!

Thank you for sharing your story! I will say the same as some others your story is much like ours. We are at the begining of becoming debt free, it was really encouraging to read your story. I know it would be difficult for me to share our details, so I applaud you and thank you for being transparent. It was just last night that my husband and I made a renewed commitment to paying down our debt, what ever it takes. I am ready to change my family tree. Your story came at the perfect time. Blessings to you and yours!

Our story is so much like yours. We thought we were OK because we were using our money for “good” things. I have started a blog which is making me more accountable because if I put it in writing it is so much more real! Good Luck with your journey getting out of debt.

Blessings,

Kris

I so hear ya sister! My husband and I are in the same boat (to the tune of about $45,000), but the game we got sucked into was the buy now, make no payments for 6 (or 12 or 18) months. We always thought “Oh we can pay that back before the deadline” and then we never did! So now it’s come back to bite us in the butt! But we’re workin’ on it and in the mean time, no more spending on things we really don’t need! Thanks for your honesty! It’s very refreshing!

I sure appreciate your honesty. It really is shameful to have to admit to the world that you let your money get ahead of you. My husband and I have been working on eliminating our credit card debt for about three years now. It’s been a long and frustrating journey, but there’s finally light at the end of the tunnel. We’re down to the last four thousand on our last card!

In all honesty, we did have some unexpected things happen: got pregnant right after we got married, my husband was still in school, our daughter was born with complications and my husband lost his job, then switched one other time in the next year. All these things add up to: use the credit card. But we’re finally recovering and we feel so good about it.

One of our strategies was to eliminate the usability of our credit cards. It’s easy to get used to using a cc that you do it even when you don’t need to. Another thing is that we got smarter about which credit cards we applied for, and transferred as much of our high-interest balance to 0% interest cards. There’s a small fee for the balance transfer, but we did the math and figured it was still way less than paying up to our ears in interest. So I would encourage people with debt trouble to pay attention to the interest, and find ways to not pay it. I also had a friend who worked for Sally Mae (student loan company) that 1 extra payment per year than what you are required can make a big difference in how quickly you pay your debt off.

Thank you so much for sharing this. My husband and I have finally gotten ourselves out of all but our student loan debt (although that is a HUGE but!!), and we are learning to see how easy it is to buy something that we can’t afford, just because it “seems” like we can afford the monthly payment. Thank you for being so transparent and encouraging the rest of us to get out of this trap!

thanks for your post, amber. SO true. once the new purchase “buzz” has worn off you’re left with debt stress and less money. ugh.

I am right there with ya!! Except I have a wonderful husband who is a born saver, and of course I am a born spender…we dated for 7 years and when we married he was determined to help me get rid of all that credit card debt. Last year alone we paid off 12 credit cards (it was rough since I gave birth to our first born right in the middle or the year). I love watching the balances get smaller as we go, and counting down the months until another one is paid off! Our goal is at the end of next year to be debt free besides the one vehicle we own! I am already counting the months!! It really does feel great to pay those down and off and have money to go out and enjoy!

Debt has always been something that scared but even we bought our first car together forcussing more on payments than the amount of the car, had student loans, and still have a mortgage. There is nothing like the feeling when you finally get most everything paid off but an even better feeling is when you start paying for everything in cash.

What a great point! Thank you for being honest about being in debt.

Good for you for living up to your obligations! I despair of a society where every other add is “Do you owe 10,00o dollars or more to XX. Let us settle your debt for pennies on the dollar!” When we get ourselves in trouble (and we ALL do, in someway or another) we need to get ourselves back out. Thank you for not passing that cost along to the rest of us!

I know Crystal has chosen not to take a mortgage, but I think a home is one time when it is ok to buy more than you can afford at that moment. That having been said, we do have to think about whether that monthly cost is something we can afford in something other than the best case scenario. Same thing with the other “good debts”– education, home renovation, etc.

Thank you so much for sharing this. I think this has gave inspiration to us all, or at least to me.

I think there are so many people in your shoes! We used to be in that situation. (Looking at the monthly payment instead of what you are actually paying — including the interest!) We came close to doing it again. We wanted a new camper but with our previous home’s short-sale we couldn’t get approved. So we searched for a used camper, found one that would work for us perfectly and used our tax refund to pay for it. No monthly payments! It’s so freeing!

It’s good to hear that others struggle with the same things that I do. Stuck between the rock and a hard place, but yet can still make those monthly payments. This happened to us too and we are slowly working ourselves out of it. Good luck!

Just wanted to thank you so much for sharing this with us.

Thank-you for your awesome post. Your voice is respected and people will listen to what you have to say, I sure do! I appreciate the wisdom.

I just wanted to tell Amber how brave it was of her to write this and how it is encouraging to read something so real and frank.

Oh, so many people are in the same situation!! I do think though that if you have to make monthly payments on living expenses (ex. house payments versus rent payments—and that is probably 100% of us), the house payment is better. (Unless you can afford to make rent payments and still put aside enough to eventually pay cash for a house. ) An option would be rather than a 30-year mortgage, buy a less expensive house on a 15-year mortgage. The monthly payments are much higher but you pay off the house much faster and pay much less in interest. But these people who get talked into a much bigger house than they can afford (balloon payment loan or one of those other subprime loans) are asking for trouble.

What a fantastic post – and great comments too! Thank you so much for the wise counsel!

I know how that feels been there… but we couldn’t afford anything. We were using credit card just to pay for groceries after taking out a 2nd mortgage to pay off the credit cards. It sucks and we were losing everything. We went to a Credit counselor who told us they could do nothing for us… (how do CC tell you there is nothing they can do for you!…oh yeah we were also 3 months behind on our mortgage). It was devistating. My husband was working 96+ hours a week and killing himself. We finally came to the realization we couldn’t do it anymore. (the major thing was our house payment it was more than on of his checks a months.) We filed bankrupcty in August of 09. We haven’t made a house payment since April of 09 and we are still here and haven’t even got a letter about foreclosure yet. Its a very very very scary thing to think of losing everything. I am 23 years old and now know that I will never ever own a credit card again. I was looking at a pile of papers that my husband got when he bought the house (he bought it before we got together) and in it said that after 30 years he would have paid $400,000 dollars for a house that he bought for $180,000. That SICKENED ME! I told him I never want to buy a house unless we pay cash. Its just ridiculous what they do to us.

Oh I so hear you…. Our problem is when I became a stay at home mom we cut our income in half and didn’t have enough to survive so we continually went into debt! We didn’t make getting out of debt a priority when I was still working so it just snow balled once I quit. We’d be great right now IF we didn’t have so much debt! After struggling for several years now, Hubby and I recently became determined to fight this MONSTER hanging above our heads. We are trying very hard. I know it will be a few years but we are determined to do it!!!!!!!!!!!!!! Good luck to the rest of you, too!!!!!!!!

My husband had lots of debt from bad decisions before I married him. I was determined to show him that credit cards are not wise. We did not get into any debt from our wedding, nor have we used his credit cards since. Things have been difficult(no health insurance yet, apartment etc etc), but I am happy that I have helped him and he is too! We love each other more than anything, but to all you newly weds out there-Stay out of debt! It is a hardship.

I was in a situation like this almost 10 years ago, had lots of cc and loans and payments galore, sure I made all those payments each month, with a struggle, but we made them; then I left my husband ( very abusive situation) after almost 10 years and was on my own, no family around ( my family is 1000’s of miles away in germany and we are in Florida). hardly any friends 2 little kids and a part time job as a Pizza Delivery girl and TONS of bills.. a mortgage,carpayments and lots of credit cards that the soon to be ex decided to run up while we were going thru the divorce,mind you 2 stores let him use MY name and run up more then $1000 on each … back then no one cared about fraud.. anyway… there I was, no help from anyone not even the government cause they didn’t care so I hardly had money lots of bills and GUESS WHAT… I worked my way thru on my own; no Dave Ramsey no government help with all those bills and 2 little kids and no family … I made it I guess people say the american way;I faught worked FULL time the Pizza delivery place, and part time at 2 other jobs, I had to rely on some co-workers to watch my kids while daycare was closed and I admit at the time didn’t feel bad not being with my boys because I had to get us thru this, I did this for 2 years worked worked worked as hard as I could paid of one little bill at a time, finally after 2 years I got a real JOB at an attorneys office, they helped me thru classes and training and I been there 7 years now, now 7 years later all that debt that this ex had cause me and we ahd thru the marriage I paid off on my own; I work only my 9-5 5 days a week job and I’m proud to say I did it all on my own, now I’m remarried and have another little angel and we have NO CC debt whatsoever; and will never have any. I do have a Car and Mtg BUT honestly what we went thru years ago this compared to nothing, if all goes by plan I will pay of the SUV within the next few month and all we have left is the mortgage, we put 50% if not more every month of our income in savings, use coupons galore and stockpile; and the best part… after all we went thru now we have money to do things we went on 2, yes that’s right 2 Disney Crusies last year and are ready to book another one in the next month for this summer, alle are paid cash and no finace… it is possible,put your mind to it. I came from $50K plus in debt ( not counting the house and car) to $0 in 8 years with no help just a strong will power; my hubby now is proud of what we have and he is learning right beside me that CC is not the way to go…..!!!!!!!!!!!!!! You can do it it will make you soo much happier

Sorry for so long BUT I wanted to show that ANYONE can do this if they put their mind to it… I love my life now OHH and the best part if you look at us you would think we have money, we don’t we know how to budged and handle but my ex husband remember him??he filled Bankruptcy after the divorce and still has debt galor, people call my house after almost 10 years of split asking for money looking for him, he has no house, moves out of appt one after another, moves from one job to another.. he hates me for what I have and thinks he deserves all of it BUT there are choices in life and it all depends what you choose at the time and what choices you make, it’s up to you it’s your life think, make the right choice if not sure think again think some more don’t run out and buy this because you can think do I need this, will I still need this tomorrow, and wait a few days your probly won;t need it…….

Boy did that feel good to let it out…. hope you don’t mind the long post.. Have a great weekend 🙂

@Melanie,

congratulations! It is hard work to pay off debt and then to learn from your mistakes and not get into more debt. What you taught your children was what they needed to see.

@Melanie, AWESOME and inspiring! Congrats on your better life.

I admire your courage! Forget embarassing – saying things outloud is often the key to making progress. Denial never does any good….

I think its great that you decided to share your story. We’re all on here searching these awesome websites for deals, but sometimes it seems each author has already “got it all together” and here I am struggling! Not that all these ladies aren’t extremely honest with their stories and struggles because they are, but I feel they have the right ideas and I’m just running to catch the boat! lol Hopefully this will give you some hope as we all comment about the ways we’ve fallen short. If those ‘monthly’ sales pitches didn’t work so well on everyone, they wouldn’t do it. You’re not alone…..keep on keeping on!

Wow reading these posts is like reading my life’s story. We been married 21 years, have 9 beautiful children, survived a house fire last year but are still in lots of debt!!!! The same way we all get into it….low monthly payments. So with our refund this year we thought we would be in great shape, we can pay off lots of debt and remodel the one bathroom that was not touched by the fire and help our daughter pay for her wedding–NOT Just when we were able to breathe for a second, our one sewer line has tree roots in it. Another unexpected largely expensive job!! But it is true, putting your trust in God is what we are doing and never signing up for monthly payments AGAIN!!! Thanks for the great post!

I think we are twins. we are going through the same thing.

thank you so much for sharing and adding to truth. We are also in a similar situation. in debt because we made poor decisions based on what we could pay monthly – never thinking this bondage would last YEARS! But i think when more folks fess up, get over the embarrassment and realize so many of us are alike it become easier to deal with and we encourage one another – like you just did. so thank you.

Thank you for your thread and overall site. My husband of 4 years owns his own business and as many of you know that has its benifit and disadvantages. In an effort to be debt free (in NJ). I shredded all my credit cards. I made a photocopy beforehand in case of emergency. I only use cash. The other way I make sure I stay true to my goal is I print a monthly calendar and write down each bill and it’s due date as it comes in. We do have a mortgage. We purchased our home in 2007. That debt will not be paid in the near future but other items such as both our trucks, credit cards, student loans are on their way to being completed. Thankfully by the grace of God we are not far from our goal.

I am 29 turning 30 this year. I am a mother of one and currently are living as a one income family. Its tough but we make it work. I enjoy taking my son to many events and places so i make cuts elsewhere. It is working so far. I also find that if you set a goal on what you want to put away each month it is obtainable! We can do this ladies!!!

Please, please….don’t be embarassed. There are so many of us just like you out here. How about my idea for buying a car….I charged it on my visa…..oh yeah….now isn’t that a peach of a decision,lol.

What you said totally resonated with me! A long time ago my dad bought his car on his Visa. *sigh

I know the feeling. We have done some similarly crazy things. We bought a duplex that we assumed we would be able to refinance when the 3 year ARM went up. Unfortunately, shortly after we closed my husband lost his job. Plus we put a bunch of money in our credit card so that we could fix the place up. We had been debt free for only a few months at that point. It was bad news.

Fortunately, we realized the error of our ways and went to God for help. He guided us to sell our duplex (for loss) and move to a new state (far away from our families) without even a job to support us. We were able to sell right before the market crashed in our area. We did as He commanded and He blessed us! It is amazing to see how much God does for us, when we will just ask and listen.

He blessed my husband with a great career working for a great company. This company is paying for him to become an electrician. He has blessed my husband with a hard work ethic so that the company gives him raises even when there is a raise freeze at work. The company has reassigned him to different departments when they begin layoffs so that they can keep him around and employed. And that is just a small sample of our blessings!

When we moved we had $30,000 worth of debt. We have paid off over 50% in the last 3 years. We just paid off my student loan this year with part of our tax return. The rest will go to other credit card debt. Yes, it take sacrifice. Yes, it can be hard sometimes, but the pay off is amazing!

I can SO relate to your post. We bought our house and only looked at the payments, not really paying attention to the total price (which would be almost $600,000 more than the house was worth!) and now we’re really paying for it!

This is the painful truth! Thank you for sharing your experience. It is sad that so many cars and houses are sold on the monthly payment. The car salesmen and realtors/mortgage brokers are often out of their comfort zone when you actually want to negotiate the total price and not the monthly payment. Be sure to stand your ground and do what is best for your financial situation and your family.

@Holly, I like this comment. We need to realize this purchase is for us, we will bear the consequences and/or blessing of each purchase, and stop worrying about confrontation, belittlement, or sounding CHEAP! The salesmen may be dragged out of their comfort zone, but often we are, as well. This is very hard for myself because I tend to be such a people pleaser!

@Holly, Good comment. My husband always asks for the total price when we’re making a big purchase and the sales people seem confused by the question Like it’s not really relevant or something!

My dh and I are in the same boat. The worst part is when we were racking up all this debt, I heard God’s ‘still, small voice’ telling me not to get into debt, but I didn’t listen. The amazing part is, God has forgiven my disobedience and has blessed us with the money to pay our bills each month. It’s very tight each month, but we still manage to meet every obligation.

Moneysavingmom has been such a blessing to us! I’m old enough to be Crystal’s mother, but I’m learning so much from her. Thanks, Crystal and may the Lord bless you!

Hubby and I have learned that lesson. We got married in Hawaii and flew home on borrowed money from the bank, because we COULD afford the payments at that time. We had financed a brand new truck (in Hawaii, big mistake), we took out another loan to pay off a couple bills and I went back to school, taking out a student federal loan.

We moved back home 15mos ago. That first year was SO tough, we were renting a townhome, paying for utilities and I was 5mos pregnant with our first child. We made it, but barely.

We filed our taxes and used our return money to pay off two loan payments ($330 a month!) We are now paying more on my car and the goal is to have it paid off by May, June at the latest.

Amber,

I too can totally relate to this post and what you are going through.

So many “monthly payments” I added up just yesterday how much I pay each month in debts not counting my house and it was $1700!! How did we ever get to this point?? One monthly payment that we thought we could handle at a time.

Thanks for this reminder that we need to be good stewards of the money that has been blessed on us.

I have been in your same shoes, honey! My husbands cabinet business fell to bankruptcy, as did our personal finances. This was not fun but we can still “Count it all joy” because of the financial lessons and humblness it created in our family. Your honesty is such a blessing and thanks so much for the post!

What a wonderful post! I think people get lost in that monthly payment thinking and don’t consider how much they are really spending. I once bought a car and traded it in on an upside down loan, continuing to pay for a car I no longer drove because the new payment was lower.

We are now completely car payment free and fully own 2 cars. This is a first for me and it feels great! I will never go by the monthly payment thinking again.

Amy

I so get that! We are closing on the sale of our house next Friday and have credit card debt for it- new water heater and a deck (the other one didn’t pass inspection). So once we get the house sold, we have to pay off that debt. Bummer.