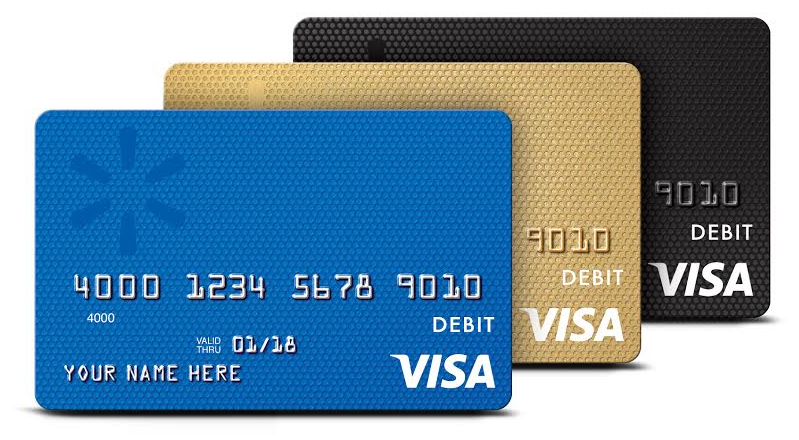

This post is the first post in a three-part underwritten series of posts I’ll be writing on behalf of the Visa Clear Prepaid program and the Walmart MoneyCard.

Struggling to follow through with that budget you’ve set? Here are 5 tried and true tips, tricks, and tools to help you actually stick with your budget:

1. Create Motivational Goals

Want to have more momentum when it comes to saving more and spending less? Set some realistic but inspirational goals.

Goals give you purpose, passion, and drive. They make short-term sacrifices more worth it, because you know you have long-term benefits in mind.

Wishing you could pay cash for Christmas, pay down your credit card debt, save for a piece of furniture, or even pay off your mortgage faster? Sit down and look at your current budget. See if there are areas you could streamline or cut back in.

Do the math on how much you could save or put toward your debt if you were to cut back $10 or $30 or even $50 every week. Knowing that these cuts are going to propel you toward your end game more quickly will inspire you to follow through with them over the long haul.

2. Focus on the Bite-Sized Chunks

If you want to discourage yourself, look at your savings goal or debt left to pay off as a whole. It probably looks mammoth and insurmountable. And you’ll want to quit saving or paying down debt immediately because it feels so overwhelming.

This is why I’m a big fan of breaking your big goals down into small pieces. If you want to save up $500 to pay cash for Christmas this year, don’t think about the $500 amount as a whole. Cut it down into the amount you’d need to save each month (about $42) and then the amount you’d need to save each week (about $10.50).

When you look at the weekly amount, it feels much more doable. And you can start to get creative to come up with simple and outside-the-box ways to shave that $10.50/week off your current budget.

In addition, you’ll be much more apt to stick with your budget if you feel encouraged from the get-go and like pulling off your goal is actually a reality, not some far-fetched, pie-in-the-sky dream idea.

3. Pay With Cash or a Prepaid Card

You all well know that I’m a big advocate of using cash. The beauty of cash is that it gives you instant self-discipline: when the money’s gone, the money’s gone.

You can’t go over-budget when you only use cash. Well, I mean, you can, but you’ll be robbing another budget category to do so.

You also can’t spend more money than you actually have when you only use cash. It’s a very visual way to be able to track how much money you have to spend.

However, I know that cash is not always practical in every situation. It’s impossible to pay with cash online and some people find that it burns a big hole in their pocket — causing them to spend more money than they would if they swipe a card.

That’s why an alternative to cash you could consider would be using a prepaid card like the Walmart MoneyCard® Reloadable Prepaid Visa® Card, part of the Visa Clear Prepaid program. It works very similarly to cash in that you can’t overspend with it — once the money is gone off the card, you are done being able to swipe it (unless you refill it). So it gives you instant self-discipline, too.

Using a prepaid card is especially a great option if you’re wanting to stick with a specific budget in a specific budget category. For instance, if you set a budget for your Christmas gifts and you want to make sure that you don’t go over it, if you designate your budget amount as the amount on the card and you don’t use anything but the card for Christmas gift purchases, you’ll be guaranteed more likely to stick with your budget. Plus, you can use the card both online and offline.

4. Use a Money-Tracking App

Money-tracking apps and websites can not only help you set up your budget, but they can help you continue to stay on track with it. There are a variety of apps and sites out there — each with their pros and cons.

These apps and websites typically take you step-by-step through the process of creating your budget and will then give you real-time reports on how much you have to spend in each budget category. As you make purchases or deposits, you can update your budget in just a few seconds.

Used well and updated daily, it’s almost like a virtual cash envelope system — without having to mess with any cash or coins at all. Plus, the pie charts and information available at your fingertips will help you better know exactly what your current financial picture looks like and encourage you to continue to stay on track with your budget.

5. Get an Accountability Partner

I cannot stress the importance of having some built-in accountability when it comes to budgeting. You need people to help you stay the course, even when the going gets tough.

Accountability can be found in many different places. It could be monthly Budget Meetings with your spouse. It could be posting your financial goals on your refrigerator in graph form and updating your progress on saving or paying down debt as you gain momentum. It could be a goal app like Commit.

It could be reading books and blogs that inspire you to practice better money management. It could be joining an online group or online community of others who are seeking to get out of debt.

For best results, choose multiple accountability sources — some that are in-person and regularly check-in with you and some that are just motivational online or offline resources that serve as reminders to stick with your budget and keep going.

You don’t have to always feel like you’re falling off the Budget Bandwagon! Implement at least a few of these tips and tools and you are bound to experience much more budgeting success!

What helps YOU stick with your budget? Tell us in the comments!

This post is underwritten by the Visa Clear Prepaid Program. With the Visa Clear Prepaid program, there’s less stress in choosing and using a prepaid card. Cards meeting the Visa Clear Prepaid standards provide you with transparency and protection, resulting in more time to do the things you love.

With a card that meets the Visa Clear Prepaid standards, it means your day-to-day activities are covered by a clearly communicated fee plan, so you’ll know when you’ll pay a fee and when you won’t. Go to Visa.com to find the prepaid card that works for you.

And stay tuned for a 30-day Grocery Spending Challenge we’ll be running in partnership with the Visa Clear Prepaid program and the Walmart MoneyCard in the upcoming weeks to encourage you to stick with your budget, spend less, and save more!

Prepaid cards seem like such a hassle to me. I have never heard you talk about them so interesting you are endorsing them (not a criticism), I’ve just always heard you be such a strong advocate for using cash only.

I don’t really see how having a “Christmas fund” prepaid card is any different from having a cash envelope for the same purpose. I can swipe that prepaid card just as easily I can take cash out to buy a fancy coffee that I’m hankering for. A prepaid card doesn’t save you from a lack of will and discipline.

My issue with prepaid cards is the fees (which aren’t huge, but they are still something) and what happens when you have a, let’s say, $4 balance on a prepaid card that you set up only for a temporary purpose (like Christmas). You either have to that balance on something random that you didn’t originally plan to buy that costs less than $4, reload your card (defeats the purpose of temporary) or let the fees eventually eat the balance up. I’d rather just keep my $4 in cash.

I’m very surprised to hear you endorse this, but that’s just my personal opinion. I still love your blog.

Thanks so much for commenting and sharing your honest thoughts!

I’ve mentioned prepaid cards here and there when people have asked for cash alternatives and also in person when people have asked for advice for how to pay for things online without going over-budget. Since I love cash so much myself, I thought long and hard before saying “yes” to this opportunity. In fact, we went back and forth multiple times to make sure they’d allow me to strongly encourage cash and not just spout off “everyone should use a prepaid card”. (At first, they said I couldn’t promote cash and I said that I couldn’t post about them then and would pass on the opportunity.)

(I’ve turned down hundreds of thousands of dollars worth of opportunities over the past five years from credit card companies and companies that wanted me to promote something that was not in line with what I personally feel completely comfortable endorsing, so I have no qualms at all from walking away from offers that I don’t feel like I can stand behind 150%.)

I only ended up saying “yes” because they said I could still strongly encourage cash and because people have been begging for some cash alternatives that would still allow them to stick to their budget. I feel like a prepaid card *can* be a great alternative in some cases. I know that this is not for everyone — especially not for someone like you who loves cash and has great self-discipline — but I want to try to present different options and this was one I felt I could endorse as it was encouraging people to stick with a budget and use their own money.

I love the idea that you cannot go over your budget with a prepaid card. Yes, there are fees, but they are so minimal compared to what you could pay in credit card fees if you went over-budget and couldn’t pay off your monthly bill.

That said, I still love, love, love cash — for the very reasons you mentioned and many more! 🙂

My husband and I both use credit cards which we pay in full every month. They both accumulate quite a few hundred dollars in cash back over the year. this money then goes to our son’s saving account. i do the same with all the money I get from cash back apps. I think it is an easy and affordable way to put some extra money in his saving account.:-)

I love setting financial goals. My husband and I have found that this motivates us like nothing else. After we finished saving enough to have a credit card free summer (my husband has variable income because he is a graduate student), we are currently saving for our Christmas budget. We have a literal envelope that we put any extra money into. I put all of my Teachers Pay Teachers paycheck, my Ebates money, etc. right into that envelope. Once we have reached that $400 goal, we’ll start saving for next summer!

We track all of the money we spend, so it makes it easy to see where it goes. We use Quicken for overall categories, and we go over any receipts or money spent during the day each evening (most days don’t involve receipts or spending money; and if we do it’s only one or two things, so it’s not as onerous as it sounds). This helps to keep us both on track.

Great ideas! Thanks for the post. Dave Ramsey just came out with a new budgeting site called Every Dollar, and it’s free! Here is the link: https://www.everydollar.com/.

Thanks for mentioning that again. I also linked to it in the post!

We use cash (in envelopes) for some things (eating out, hair cuts, groceries, spending money) and credit card for vehicle gas, miscellaneous and medical (but each of these categories has an allotted amount to cover these expenses)–we pay the credit card off each month (we earn points toward gift cards). On the refrigerator is a paper that I keep a tally of the miscellaneous expenses and the balance of the misc money– we stay in budget because you see it every time you open the refrig. It is like a game to me making sure we stay within or even below budget. Excitement is finding another way to save money or not buy something.

I use the app ‘Daily Budget’! It is by far my favorite and I have tried many different ones! I love how it gives me a daily budget to stick to rather than a monthly.

Thanks so much for the recommendation! I’ve not heard of that app and will have to check it out!

Knowing where the money is allotted to go at the beginning of the time period is helpful for me. I know just how much there is to spend on each category and that helps me keep track and not go overboard in one particular area.

Using cash is my favorite way to stick to the budget. You can’t buy what you don’t have the money for. We love using an envelope system to make sure we don’t spend more than what we have.

Envelopes, paper or virtual, are so integral to living below our means. I love their flexibility too. If I’m struggling with a coffee habit for a season, I just make a coffee envelope. Guilt free spending.

If I’m remembering correctly from my days working retail, there are added fees on these prepaid cards. If you are on a budget that’s something to keep in mind.

You are correct. These cards charge a monthly fee and an inactivity fee according to the link.

I was wondering about that. Yikes, that sounds like a lot of money in fees!

Personally, I think it would be a lot more frugal/reasonable to get a credit card with a low limit for online purchases, and pay if off in full every month. Just keep it in a drawer and don’t take it with you when you go shopping if you’re worried about overspending.

I suppose the fees might be worth it if someone has a problem with overspending online and needs the extra help to be disciplined and I know different things work for different people, but to me this just does not sound worth it at all. I wish there wasn’t such a stigma against credit cards (in the frugal world), because being able to use them wisely and prudently can be very helpful.

To clarify: The Basic card has a $1.88 open account fee, a $3 reload fee, and a $3 monthly fee (that is taken out of the card balance itself). So if you’re using it for something like Christmas purchases, it can be a MUCH safer/better option if you tend to go over when using a credit card, want to make sure you stick with your budget, and don’t want to mess with cash.

I’d recommend getting the card for a specific purpose only and for a short time only and then closing it once you’re finished paying for Christmas, etc. I’ll be talking more about this in the Grocery Challenge post that I’ll be doing in a few weeks.

{And personally, this is why I LOVE cash — because I never have to worry about any kind of card fees!}

Hmm . . . that still seems like a lot to spend my own money! (If someone opened one now, that would be $15 in monthly fees alone-I can buy at least one other present for that!) Personally I would prefer making a tiny bit off my Christmas presents in the money-back percentage we earn on our credit card, but I can definitely see where it might be worth it to someone who can’t stick to a budget with a credit card!

Different things work for different people, but I just think there would be more people who could stick to a budget with a credit card if they weren’t such a bugaboo in the frugal world. Honestly, I still feel guilty sometimes admitting that we use one, even though cash envelopes totally did not work for us, and credit cards do!

For many people, that $15 could save them as much as $150 or more (because it would force them to stick with their budget and not overspend), so it’d be worth it. But again, this is why I love and prefer cash — no fees, ever! And this is also why I’d only recommend these if you struggle to stick with a budget, cash doesn’t work for you, and it’s for a short-term purchase.)

Did you read this post on why I don’t think credit cards are evil? 🙂 If not, be sure to do so:

https://moneysavingmom.com/2015/06/no-i-dont-think-credit-cards-are-evil.html

{I just can’t in good conscience promote or endorse them here, because 1) I don’t use them and 2) I have seen way too many people get into serious financial trouble with them. However, at the end of the day, it all comes down to self-discipline — which is one of the things I try to encourage people with most. If you don’t have that, you’ll never be able to experience much financial success — no matter what system you use for payment.}

So how do you use pre-paid cards? From your above comment on credit cards (“I don’t use them”), since you are endorsing and taking money from corporations selling pre-paid cards, you must be using them.

I can’t figure out when it would be worthwhile to use a prepaid card (unless it was given to you as a gift). In the Christmas budget example, you would be eating a large portion in fees by adding to it each week or month and by holding it for a long time. If you have the cash up front to buy one, you’re better off just buying your items in cash or if purchasing online, buying a gift card for the online retailer then purchasing the item.

We had to have many discussions with Visa before I signed the contract to do 3 posts with them because it was incredibly important to me to be sure I could wholeheartedly stand behind posts that endorsed a card of any kind. We have used pre-paid cards for various things over the years. For right now, we have one that my assistant uses for personal purchases. This way, we can budget for it, but I don’t have to give her cash from an envelope if she needs to mail a package or buy a gift for someone, etc. for me. We budget a certain amount for this card every month and it’s been a great option for this type of situation for us.

We’re also going to be doing the Grocery Challenge using a pre-paid card, just to compare if it makes any difference for us (harder or easier) versus our usual cash method. I’ll be blogging about that each week during the challenge. Stay tuned!

What I like about a pre-paid card (for people who don’t like using cash or find that they spend more with cash) is that it’s your own money and you can only use as much as you designate for it. So there are never any surprise credit card bills or spending more in your bank account than you had planned to spend. If you struggle with over-spending, it can be a great alternative to consider to help you learn self-discipline and sticking with your budget.

I think that the gift card idea is a GREAT one, too — especially if you’ll be buying all of your Christmas gifts at one store or online from a place like Amazon. I know some grocery stores also have great perks for buying gift cards in large amounts and that’s an excellent option to consider, also!

Oh, sure! That’s why I did say that I can see where it would be worth it the person can’t stick to a budget using a credit card. 🙂 Although I do really like Kay’s idea of buying the gift card!!

And fair enough!! I certainly wouldn’t want you to endorse something that you didn’t feel that you could, in good conscience promote.

I have read the article you linked to, but honestly, it (especially the beginning) read more like encouragement not to use credit cards than anything else! But you definitely have always done an amazing job at encouraging people to do what works best for them!! (And you got to that by the end of the post.)

I just wish (because of Dave Ramsey’s views on credit cards) that someone big in the frugal world would do a balanced view of credit cards, including how they can be useful and how to use them properly. I do worry that people just aren’t being given the full picture and end up in situations where they really need a credit score and don’t have one. 🙁

But that’s not a criticism of you! You should definitely only write about a promote what you feel you can, in good conscience, promote!!

I agree with you. Credit cards can be quite useful. My husband and I put just about everything on our credit card because it has a generous cash back program. I am actually grandfathered in on this card – it not has a fairly hefty annual fee (which I will NEVER pay!). We pay it off every month and get about $1000 cash back every year. Sometimes I use it throughout the year but mainly I save it up and use it to pay for Christmas gifts and the extra food we need for hosting family. It’s better for us than cash because we see where our money is going; cash just disappears when we have it. But to each their own!

Lisa, I completely agree that credit cards always get a bad rap in the frugal world, but yet can be used in a very smart way. My husband and I are diligent credit card users {he actually spends more if he has cash in his pocket!}, and we pay them off in full every month. As a result, we take home about $500-$600 per year in cash back, which is pretty significant if you think about it. As for prepaid cards, I’m with you — I just can’t see past all the fees.

When I first got married, we used cash for everything. After we got used to having a budget, we didn’t need to anymore. I love not using cash anymore but it was fun while we did it! 🙂

http://www.sweetlytattered.com