Guest post from Tiffany of Don’t Waste the Crumbs

Do you have a planner? I do.

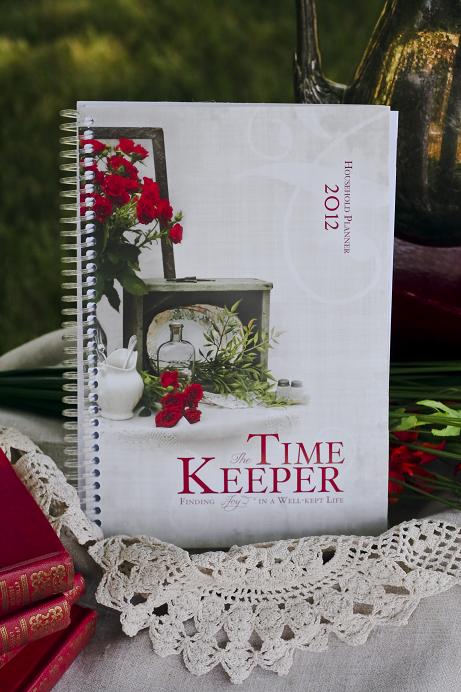

Actually, I have a pretty incredible planner (that I saw here on MoneySavingMom.com) and I write just about everything in it: meals, birthdays, to-do lists, chores, grocery lists, appointments, things not to forget. That is, unless I forget to write them down.

And in that case, nothing gets written in it, and then my planner isn’t so incredible after all. But I can’t really blame the planner now, can I? 🙂

Today is 2012 Tax Day. I celebrated by getting our taxes done. I know — nothing like waiting until the last moment, right?

Actually, I’m ahead of the game. I got our taxes done on Monday.

No need to remind me, I know I’m cutting it close. But at least I’m not late! (And yes, this is a reminder in case any of you forgot!)

As I was attempting to do them myself last week, I realized that I could have done them so much faster, with so much more information, and so much more accurately (and in turn, not needing to go have them done by someone else) if I had only kept up with my planner!

You see, I do write down a lot of information in my planner, but apparently, there’s a lot of information that I didn’t write down.

- If I wrote down every doctor’s appointment for each member of the family, I’d know what doctors I needed to contact to get records of payments made to the office.

- If I wrote down the reason why we had an appointment (wisdom teeth extraction — ouch!), I’d know whether or not there was a prescription to go with that appointment.

- If there was a prescription, then (in theory) I would have written down how much was spent and where it was spent (since I write down everything we spend).

- If I went to the eye doctor, it’s usually because I needed glasses or contacts. How little did insurance pay much did we pay for those again? Did we buy them online instead? What about that fitting fee?

- Wait, didn’t my husband go to the eye doctor, too?

- Exactly how much contact solution do we go through anyway?

This is just a glimpse into some of the thoughts that were spinning in my head, while seeking comfort in a bag of left-over Easter jelly beans last week.

I had a revelation: my planner was good for more than just properly managing my household day-to-day. Using my planner to its fullest could actually save me money.

Suddenly, I have a renewed interest in my planner and will do my best to do a better job of writing more details down in it to save me time and money come Tax Day 2013.

Tiffany is a full-time mom who teaches part-time and blogs at Don’t Waste the Crumbs, sharing ideas on kids, food, frugality, and making the most out of the small pieces of life.

plus if you use a FSA that saves you through the year!

there is really no need to write all this down. At the year end, look at your claims ONLINE, your ins. company willhave them listed out with copays and out of pocket. your pharmacy insurance will have the same. I contacted the hospitals and MD’s for receipts but got all my information online in 1 or 2 places. Just FYI for next year to make things easier!

and though we spent 10 grand out of pocket we still were not able to deduct-the % keeps going up but still keep track.

Ouch, a touch of reality that nothing works as great as long as we don’t use it to its full potential. That was a great reminder of how important it is to me to write it all down, to keep myself on track and organized. Life moves along so much simplier when I keep to my schedule and keep myself organized. Thank you for this great reminder.

Wow, I never would have thought to keep track of that stuff for taxes. It doesn’t matter right now since I don’t make enough to owe taxes, but I will definitely keep this in mind for when I do! Thanks.

I adore Tiffany’s writing – creative and funny. Great post!

Didnt knew all those things can be deduce. Anyone where I can get a list with all the deductibles. I will like to be more prepared next year.

I love this planner! She emails me when it is time to re-order so maybe you can contact her to put you on the list for next year.

Why would you put a post up with a product no longer available?

The post was about using a planner — not about a deal on this particular planner. My apologies if that wasn’t clear.

I just linked to it since it’s the one she uses and she had linked to it when she submitted her post. I hope that clarifies. The new 2013 planners from this company will be out in the fall, if you’re interested in trying them.

Most of these things can be found in my budget. For each line item, I can make a note, which I often do if it is an ununsual event.

Yes, I have a file folder AND an excel tracker for everything — dr apts, Rx, donations, etc. I also take pics of my donations (Books, clothes, etc) as documentation of value. Here’s my question — what does how much contact solution you buy have to do with anything? I want to make sure I’m not missing something or a deduction. I used to track that for our Health Reimbursement Acct through work as over the counter stuff could be used for that, but not anymore thanks to BooBama. Is it still worth tracking over the counter meds for some reason? Thanks for any input.

When I was doing them at home, TurboTax first asked if we had any eye expenses – glasses, contacts, solution, etc. It gave me the idea that anything we purchase for a medical condition (like solution because of prescription contacts) would be (or could be) deductible. Since both the husband and I wear contacts and are sensitive to the brand of solution, that too can add up at the end of the year – to $240 (and that’s a conservative estimate).

Here’a a link to the IRS publication on HSA/FSA/MSA accounts http://www.irs.gov/pub/irs-pdf/p969.pdf and a link to the IRS web page that says contact lens (and solutions) for medical reasons are deductible http://www.irs.gov/publications/p502/ar02.html#en_US_publink1000178919.

That would be President Obama.

I keep my old planners in the same box as our tax records – that way, if there is any questions about any of that information I know where to look for it! It does pay to write stuff down! I’ve used mine to record baby milestones for our son, and then I eventually update his baby book little by little.

We have a high deductible insurance plan. We opened an HSA with it. We have a debit card for the HSA and I use that for nothing but medical expenses. Very handy and all the numbers were right in front of me when I did our taxes.

Can you deduct what goes through your Hsa? My understanding was since its pretax money anything taken out of there cannot be deducted. For example we have an HSA for daycare and we can only claim our costs outside of the amount in our account.

I guess my situation is a little different because, for whatever reason, our HSA contributions are not pre-tax. I thought though that either way, if medical bills were more than 7.5 % of your AGI, that anything over that amount can be deducted. So with medical bills and our insurance premiums we usually surpass the 7.5

Mary is correct. If it’s pretax money used for the HSA, you can’t deduct it when you itemize. You can’t subtract out something you were never charged tax on to begin with.

http://www.wellkeptlife.com/index.html

Website says they’re sold out 🙁 Bummer.

I’m a big fan of using a planner, but this seems like a lot work.

For health care tax records, I just keep a health care folder for each year, and put all receipts/bills into it (after I have entered the amount into the appropriate line on our Excel spreadsheet budget). Then when it’s tax time, the grand total is just a matter of looking at the spreadsheet to see the figure. As a way to check myself, and to have proof in case of audit, I add up all the receipts in the folder. It’s really pretty easy.

The key, however, is to get a receipt every time you have a medical expense! I can’t imagine having to go back and contact doctors’ offices – that would be a real hassle. I don’t keep track of mileage, though – never thought of that. We live close to everything, however.

Perhaps it sounds complicated on paper, but in practice it’s very easy.

I drive myself and both kids to all of their appointments, so naturally I write down when and where those appointments are in my planner. My husband drives himself to his, but those are the ones that I missed for taxes this year. He will get a receipt, but not always pass it on to me (and I don’t always remember to ask). He also went to a couple doctors that I didn’t have to go to, and when 12-14 months go by, I don’t necessarily remember one particular appointment that I didn’t play a part in.

My goal for 2012 is to simply write down all the appointments. Then I can make a few quick phones calls at the end of the year (each office already knew what I was wanting when I called) and I’ll receive a summary for the whole year, for all of us who went there. I can calculate the mileage. Most of our doctors are within 10 miles, but consider each individual visit (round trip) and a dentist that’s almost 80 miles round-trip (that we made several visits to last year) and it can really add up!

We live a bit more than two miles from our child’s school, but our accountant still told me to keep track of the mileage when going there to volunteer. Every little bit helps — especially as you’re adding it up with your other deductions!

You could also write down any tax deductions, like donated clothing, food to the food pantry, mileage to go volunteer somewhere (if that is tax deductible). Or work expenses so you can deduct those too. Great idea, I should started using my planner too.

I hadn’t thought about donations! I give quite often but never think about the value or mileage. Thanks for the suggestion – I’m going to writing those down too!

I definitely rely on my calendar when tax time comes. I use Google Calendar (my husband and I share calendars with each other), which has a very handy search function.

This is very useful suggestion, but I would just throw in the caution that I believe you can only deduct what is in excess of 7.5% of adjusted gross income for medical expenses. Of course for those eligible it’s important to keep track of this information very carefully, but I do hope few readers fall under that category. So this is a reminder to fund your health care accounts (and submit your bills for it)! And just a note to keep good records if you do deduct medical expenses, because this reportedly makes you more likely to be audited.

Hmmm. You’d be surprised. We are healthy (no chronic illnesses, or special considerations), but we have deducted most years. Our premiums (self-insured) are high, high deductible, no dental insurance. Every year it seems like there is something that puts us over: new baby, ear tubes, cavity jackpot, or stitches from a swing accident. With 4 kids it adds up quickly. Most visits to the pediatrician are over $100. I bet there are a lot of people like us.

And also some States do allow you to deduct medical differently than Federal… like here in NJ anything over 2% can de deducted off income to reduce taxes to the State 😉

Fair enough 🙂 My state doesn’t allow me to deduct that (but I can deduct rent), so I didn’t even think about that.

This is exactly what I have always done in the past. I usually keep most of the info on our main calendar. This year I did not use a calendar as I usually do, I was trying to do more digitally. I definitely missed it come tax time as I didn’t update the digital calendar as much as I did when I had a paper one.

However, with a simple phone call I was able to get print outs mailed to us from each Doctor, Dentist, and Therapist of each appointment we attended, as well as any co-pays that were paid. I really loved doing that since I now have a hard copy as proof to go along with our taxes.

just set up Mint.com (based on your readers suggestions) and it also do a lot to help with taxes for the next year! Thanks so much!

I LOVE Mint.com! This definitely has been helpful in preparing my taxes the last 2 years. Healthcare expenses? Just sort for pharmacy and different types of doctors. Done. Of course, this only works if you use your debit/credit cards for purchases like these, but cash transactions can be manually entered. Just keep those receipts!

Great idea….I never thought of using my planner/calendar and I live by them! I usually print a list from the insurance company’s website and pharmacy’s website as well as going through my checkbook, but this puts it all in one spot. Love it!

I have a standing file on my desk where I keep all the EOBs and receipts for healthcare spending, and other tax deductions. As the year goes on I stick those receipts in and then when tax time rolls around its all in one place. I also have an excel spreadsheet where I keep track of the date, what it was and the $ amount. That way if for some reason I didn’t get a receipt or forgot to put it in the folder I know what I still need to look for. Every other week on pay day when I update my budget and balance my bank info, I make sure that spreadsheet is up to date as well. It feels good to be organized and on top of things!

Having file folders has worked for us too. Every single time we go the the doctor or buy meds, I get a receipt and put it in the folder marked “Taxes-Medical.” We also have one for charitable contributions and one marked “Taxes-miscellaneous.” This has always worked well for us.

I kept everything in a file folder as well. Doing my taxes this year was so simple!

Ditto on the file. I always start a new medical file and a new file labeled Taxes 20** in January. From then on every receipt goes in the file. When I get the stubs back from organizations that I make taxable donations to then they go in the current taxes file along with the receipt for property taxes on house and cars, then in Jan when the bank statements and other financial documents come in they also go immed into the Taxes file until we are ready to sit down and do the taxes. It is a very affordable and easy system.

This year was the first time I was able to claim healthcare and I had to also look back and know the dates and locations of each visit-also the mileage and last year the mileage rate was different for part of the year than the other! I did a lot of back tracking to find it all (including a lot of printing from my insurance website). This year I started a folder for my healthcare and have a pc of lined paper to write down the date, location, person and mileage as we go to the doctor-WAY easier than digging thru the insurance site making sure it all matched up! Hoping this makes things smoother and more organized next year if we are able (hopefully not since we will have used it a lot!) to claim healthcare. Wish my Mom would have taught be some of these things instead of just passing down procrastination…

Where can I get that time keeper planner?

You can find more details here: https://moneysavingmom.com/2011/10/weekend-giveaway-the-time-keeper-household-planner-14-winners.html

Thank you! Right now they are sold out.