Guest post from Jenn of Hang On Baby, We’re Almost Somewhere

We used to carry debt. Mortgage, credit-card debt, car payment, student loans — we carried all those debts. I never questioned carrying debt, ironically, until we managed to work our way into being debt-free.

“Carrying” debt is aptly named. It feels like a weight, doesn’t it?

Funny how cash in your wallet never feels as heavy as debt. Here’s how debt stealthily weighed us down, and what we’re doing differently by paying cash:

1. Debt is a big fat liar.

Debt tells you that you don’t have enough. Enough money, enough self-discipline, enough reserves to fall back on.

When we reached the happy day without payments due on things we’d bought in the past, we rediscovered that we are a people of plenty. We have enough; we are enough. We can participate in charitable giving happily out of our “enough-ness.”

Our children, like many, squabble over who got more or which was bigger. We answer, “Have you ever found yourself going without? No. We are able to satisfy all your needs. Let’s share this snack/toy/activity thankfully.”

2. Debt undermines your family values.

We’re more vocal with our kids about why we use our money the way we do. It was hard to explain why we had to send a minimum payment so we’d be able to charge more stuff.

It’s easy to say, “We’ve chosen to budget carefully so we can prepare for the future and so we can pass our blessings on to others.” Since we cleared our debt load, our son decided to collect donations for a water well, instead of presents, at his birthday party last year.

3. Debt can make you lazy.

When you already owe more money than you have, sometimes it’s easier to do the convenient thing than the prudent thing. “Just grab take-out for dinner. What’s a few more dollars?”

Now, I don’t want to give our money to other people for services I can provide myself. I cook more, and find that I’m prouder of myself for planning ahead and improving the nutritive value of our meals (i.e., waaaaay fewer French fries).

4. Debt lowers the value of your standard of living.

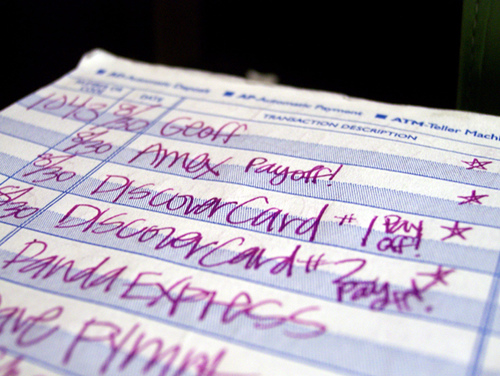

Now that saving money on the grocery budget doesn’t enable us to pay a credit-card payment, I make it a point to set aside the money that we save through sales and coupons. I actually physically place that money in a separate spot.

I don’t want to see it dissipate in a cloud of fast-food bags or children’s trinkets from the store. No, if I save it, I want to be saving for something good.

We’ve set a goal to buy an original work of art that we truly love and to take a family vacation. Those purchases seemed out of reach, and maybe even undeserved, when we owed money.

In any case, coupons and weekly specials add up quickly. A memorable purchase — with cash — will help us weightlessly celebrate the debt-free life!

Jenn LeBow is a happy wife and mom of four. She’s a native Texan who’s frequently on the move due to her husband’s career, and she loves Jesus and libraries (but can’t possibly set aside the amount of money she saves by reading library books). You can follow Jenn’s train of thought at Hang On Baby, We’re Almost Somewhere.

I was debt free until 35 except a very small mortgage almost payed off. going into my short term marraige and during no money issues and a good savings. I never overspent and very good with money. Unfortunately, my ex husband I have had to fight in court for several years to try and keep our baby seeing both of us, but he only ever wanted to take him and relocate 1200 miles away with him. I have had to spend $100,000 on lawyers. It did not work. Our poor boy went from almost everyday with me as a sahm to 2 days once a quarter except 1 1/2 months in the summer. I have no more money now and a mountain of credit card debt so I can no longer fight for our son to see us both. So it is not always spending money on things that are disposible. In my case it was to help our son have 2 parents in his life.

It is very important to start out a married life with both individuals informed on their money situation all the time, even if one is the primary bill-payer. Credit cards are a big temptation to some people (beyond emergencies or quickly repaid in full). Sometimes you are surprised in life who falls for the credit card lie. If you don’t watch your spending now you will have to endure the natural consequences later. Although being frugal is sometimes tough there is never a good time in life to be in debt.

Great post, we found the Dave Ramsey plan in April of 2011 and are getting closer to being out of dept than I ever even thought possible, its amazing what you don’t think you can do until someone shows you the plan. It is a great feeling every month to know that things are getting taken care of not just having a bandaid put on them.

Great article! It is amazing the way debt can affect the way we live w/r/t family values, our own sense of ethics, and drive.

I agree with establishing a credit history responsibly and paying off debt monthly – it helps when you need to negotiate other decisions such as insurance, new house mortgage, student loans, etc. if you have excellent credit history you get better rates. That said, my husband and I have been very careful with our $$ – paying off student debt as soon as we could, making our payments for all items on time and in full , if possible, and we have always saved for college and retirement. We are still having to take out student loans because the cost of education has risen so sharply. However, we are willing to eat beans and rice for four years so we can start to repay them when my son graduates. Our friends are just getting second mortgages on their houses to pay for their children’s college and continuing to eat out almost every night. I do hope to retire as soon as my child graduates but they will be working for the rest of their lives.

Great points! I recently made a similar list about being debt free (http://www.servingjoyfully.com/2012/05/17/why-debt-free/)…I had several of the same points 🙂 Thanks for sharing.

Congrats on becoming debt free! For me, debt was a huge burden for many years. It was just a massive weight that held you to the floor and sucked the breathe out of you at times.

My wife and I have paid off $60k over the past 5 years but we still have quite a bit left to go. I can’t wait to be free…I’m looking forward to the day.

As a consumer rights and business law attorney I see a lot of people with insurmountable debt which takes many forms, student loans, medical, unsecured credit cards, car loans, mortgages under water, etc. One thing to note that although it is commendable to never use credit, it is also wise to use credit occasionally and responsibly.

If you never use credit, you do not establish a credit score, so if and when you might ever need it (again keeping in mind to use it responsibly) you could be the best money manager in the world, but might be denied credit due to an unestablished credit history. I have worked with some individuals who had this issue when they tried to help a college-age child apply for financial aid (the minimum amount needed to supplement the education). These individuals had done every thing right and paid cash for everything for years, but because they had failed to maintain a credit history they could not qualify for the financing necessary to supplement their child’s college education. Just food for thought. I think it is smart to keep one to two credit cards, use them for incidentals every few months, and pay off the balance.

Good points, Maureen. The system is set up to reward people who use debt responsibly, so sometimes you have to work within the system. In an ideal world, going completely credit-free wouldn’t work against you, but I’m pretty sure we’re all clear that life isn’t always ideal. 🙂

Hubby and I set a goal ten years ago – to pay off all debt, including our mortgage, before moving North to be near our kids. We met that goal and moved North in 2005. Soon thereafter a heart condition made it impossible for him to work and I was laid off from my job in a real estate related industry. We are totally surviving on $1600/mo. Had we not paid off our debts during the good times, we would certainly have lost our home and probably be on the government dole somewhere. As it is, we do okay on our tiny income, and it’s all because we have no debt!! I look back at all of the money we wasted on interest and it literally makes me sick. We will never do that again!

We own a business and are constantly asked by people about getting a “line of credit”. It absolutely drives me crazy! If we don’t have the money, we just don’t buy it until we do have enough money. We told each other a long time ago that we won’t be keeping up with the Joneses, even though we know they “have a line of credit” and we don’t 🙂

this is good!

feeling especially convicted about the “lazy” one right now:)

I think debt should be kept in perspective. My husband & I have student loan debt we are diligently and quickly paying off. If we would have graduated without it, our financial decision making would have been drastically less responsible. Plus, we value our education more because we feel a sense of sacrifice. I think sometimes debt is unavoidable and how you tackle it in the pursuit of becoming debt free can be a learning/growing experience in fiscal responsibility that can be beneficial – especially in the case of student loans.

There is so much more ability and what we call “power” to make decisions where we want our money to go when it is not dictated by outstanding debt. This month is our first full month being without any credit cards after 12 years of being married. We had to replace my husband’s tires on his car as well as had another irregularly large expense. We were able to do both and still be within budget….with some left over for fun! There is such freedom in living with no debt hanging over your head. I definitely feel lighter this month! It was amazing to delete the category in Mint.com for paying off debt!

This is a great reminder of the ways that debt can weigh on us! However, I think this applies best to consumer debt. Student loans, for example, can have the exact opposite effect of the problems you listed.

While these make sense, I think these points are circumstantial to each individual person. I don’t think debt undermines your family values nor is it a liar. Depending on how you use your money, some(small) debt isn’t necessarily a bad thing. Consider that the majority of top companies all have debt, but that figure is far from saying they don’t have enough or are not self disciplined. For them, and others, including myself, it makes sense to finance some purchases in order to invest or use cash in a more profitable way.

Just my thoughts 🙂

Of course each family needs to approach debt from their own circumstances and what makes financial sense for their own choices and goals. I’m glad that your plan is working well for you! 🙂 For us, it undermined our values because when we tried to explain our budget to our kiddos, we found ourselves trying to justify the debt we were carrying. Also we didn’t do as much giving to others because we were too focused on paying off things we couldn’t even remember having bought. So, for us, debt had gotten out of hand and out of the priorities we wanted to keep our focus on. Thanks for bringing up a good point about disciplined use of debt.

My husband and I are working on paying off our debts. Thankfully, it’s manageable. I’m currently not working and my husband has a full time/minimum wage job. He had been doing construction, working less hours but at twice the pay and was miserable. We can’t wait to have our debt put behind us so we don’t have to worry about how we’re going to avoid late charges and so that we can live comfortably for a while. I really appreciate all your posts about saving and doing what you can with what you have. It really helps those of us who struggle to see the end of the tunnel, even when we know it’s really there!

Totally agree. We were close to $60,000 in debt and one day decided enough is enough. We cut up our credit cards and have not used any for 3 years. In that time we have paid off all 3 credit cards, made our last payment last month on the car and the only debt we now how is our mortgage. Things are still very tight. But we’ve learned ways to cut costs-growing our own food and deciding wants vs needs. Everything gets a line in the budget including our once a month date night.

I love it that you are saving for an original piece of art! My husband and I have purchased many pieces over the years and they still bring us alot of joy 🙂

I definitely agree with debt making you lazy. I was guilty of the “I’ll never be out of debt anyway so I might as well buy this and enjoy life” phenomenon. Then I realized (many years later than I should have!) that I was tired of being broke, in debt and bogged down with worry about money all the time. Thankfully, I was able to pay off most of my debt then meet a like-minded husband. In 5 years of marriage we have eliminated all debt – his car, my student loans and, most recently, our mortgage!

Amen and Amen! Some call debt

I agree totally with #3, I have that conversation again and again with people who tell me their weekly eating out habit is not going to even put a dent in what they owe so why bother. Debt can make you feel so stuck.

Okay, I kind of agree with this. Especially point #3 – when you have such a large amount you owe, it feels easier to spend more little amounts.

That said, I kind of wish the first two points had been written differently. I know several people who chose to take on some student loans (myself included) but are still working hard to a) minimize them and b) pay them off as quickly as possible. I don’t think that debt tells you you don’t have enough – society does. Heck, I don’t even need others to tell me I don’t have enough – my own heart can easily covet the things of others if I let it, debt-free or not.

I also don’t think debt needs to undermine your family values. There are a lot of things we are doing without right now in order to minimize our debt, and we explain that to our kids. We share a 22 year-old 2-door sedan and fit three kids in the back, and even my four year-old knows that the reason we don’t have a larger vehicle right now is that we both don’t need it and can’t afford it. And he’s perfectly content with that.

Thanks for posting this though – it’s always a great discussion starter!

I gotta chime in on this one as well. I did not have any financial help when I went off to college. Never was given a word of advice nor given direction. I was the first in my family to go to college…that being said, In my senior year, I was advised and strongly encouraged to to incur any debt and that it was sinful. I was already working two jobs and going to school full time. I ended up dropping out of school and never went back. I’m 35 now and as a SAHM I will be looking to see how I can finish. I do understand that debt was not a good thing and God does work all things together for good ( I have an amazing husband and 17mo son) but I do wish I had finished.

I think you bring up a good point about the wording. I admit that I used language that was a little over the top to get my point across, but for us, there *was* an element of feeling we’d bought into a lie by incurring some of our debt. Both of us had student debt as well as credit card debt, and we just thought you kinda had to do that these days. But while it’s not always avoidable, many times it is. Thanks for your comments! I appreciate your point of view! 🙂

Good food for thought. Can I add a #5? Debt kills your flexibility and constrains your choices.

I really admire writer and home educator Susan Wise Bauer. She has said publicly that as parents there is very little you can do that would actually ruin your child’s life, but saddling them with tens of thousands of dollars in student loan debt comes awfully close. That debt will affect what they can do, where they can live, what jobs they can take and more well into their adult life.

Absolutely, I agree. I have a good friend whose husband has the same job and makes the exact same salary as my husband (we are both SAHMs).

We have 100k in student loan debt and an underwater mortgage from a house in another state. They have no debt and a large amount of savings in the bank.

My husband gets home at 8:30pm. Her husband is home by 7. Why? Because my husband is so terrified of losing his job he stays late every night to do more work. We are totally trapped. If he lost his job we wouldn’t be able to pay the next month’s rent. If my friend’s husband lost his job, they could live well for a year or more while he found a new job, and relocate to anywhere in the world.

Thank you for posting that! Really makes you think about things. I’ll have to share that with my husband, we’ve been discussing how much we should save up for our children’s college.

Thank you for sharing that! We have one year until our oldest will be off to college. We are doing everything to “do our best” that she will have very little student loan debt. She has also been working since she has been able to drive and we have gently pushed her to save as much of her paycheck as possible. We told her that she will be thankful for that money when she is in college. I am hoping that with her job, our financial help, and some possible academic scholarships that she will need very little loans, if any at all. Fingers crossed!

Student loan debt is a little over 20% of our total debt (the rest is our mortgage). However, I would never say that my parents “saddled me” with that debt. I would never hold against them their inability to pay for my college. It was my choice to go to college and it was my choice to take out loans (for grad school…I had a scholarship for my undergrad, fortunately). My point is that there are other ways, and I would never say that my parents saddled me with debt that I made the choice to get and sign my name to.

Although, I might come closer to saying I wish they had been more responsible with finances and taught me to do the same, but that’s what we’re working on with our little ones 🙂

Ah, Crystal–I should have said she wasn’t suggesting it’s never a good idea to take on school debt. She was saying that if you’re choosing between a great state school you can afford and a $53,000/year Ivy League that you can only pay for with massive student loans, then go with the cheaper option.

Seth Godin wrote a great piece on this a few months ago, called Making Big Decisions. http://sethgodin.typepad.com/seths_blog/2012/03/making-big-decisions-about-money.html

I absolutely agree with Crystal… I also took out student loans and I would bet they eat up about 15% of our monthly budget…. and you know what I would do it all over again in a heartbeat (although I might try and apply for a few more scholarships and sign up for work study).

I’m not sure why it is the parent’s responsibility to pay for their child (who actually is likely a legal adult by the time they enter college) to go to college. My parent’s, like Crystal’s, couldn’t afford to help me with college, and I would never hold that against them or tell them they “saddled me with this debt”. I’m glad my parent’s chose to continue to invest in their retirement (so they’re not forced to live on rice and beans and live with one of their kids after they retire) as opposed to shell out the money for my college education because having to pay it on my own was the best motivation and life lesson I could’ve ever asked for.

If you can afford to help your kids I think that is wonderful, but wouldn’t it also be wonderful to help teach them the importance of saving, looking for scholarships, and working to pay for what they are getting.

I completely agree. Debt traps you and drastically limits your options. Although I had to learn that lesson the hard way I was fortunate enough to do so before I was married and had kids. My heart goes out to families who are trapped by their debt because I know how it felt when it was just me.

What stresses me out now is our mortgage debt. We bought conservatively but that was in 2005. Our house is now worth 20% less than what we paid. Even though interest rates are insanely low we can’t refinance without paying PMI or paying a bunch of money to avoid that. Since we’ve already done that once we’re not chomping at the bit to repeat the experience. And we pay an extra 50% each month! I just find it frustrating we have this huge debt we can’t do much about. If we were to put half our take home pay on the house it would still take 6-7 years to pay it off. I don’t want to complain because we’re not upside down on our house and are fortunate enough to afford everything we need but I do worry.

Beth, I’m in this situation right now and it’s really frustrating! We’re not upside down as far as the value, but we’re in a position of needing to sell it asap because of a relocation and, because of the down market and type of property (a double wide which we were misled about when we purchased it), we’re probably going to end up in the hole which is a very discouraging thought after all the money we’ve paid over the past five years in house payments. Yet another reason not to be in debt…but live and learn I guess.

Ugh, I’m sorry. With the market the way it is I can totally see how people who bought responsibly are ending up in your situation (having to sell at a loss) or upside down in their mortgage. It’s terrible.

That is so great! Hooray for your family….are you mortgage free. I went to your site. Did you chronicle your journey to freedom. More details, please. We are still staring at a mortgage that is eating us alive but we have 14 more years and then…FREEDOM!!!

Thanks for your follow-up questions! I will write more about our journey when the freedom series that started today (Tuesday) on my blog. But, quick answer, we are mortgage-free. We had a house that we were “saving” for when we settle down from our nomadic life (my husband’s job moves us to a new place every 2 – 3 years), but we realized that the likelihood of us living there again anytime soon was slim now that we have kids, and we sold it. We’re not entirely happy, budget-wise, about renting, but it’s not always worth it to buy/sell in a 2 or 3-year window of living in a new place, and when we’re overseas, buying is not even an option.