Guest post from Lisa of About Proximity

Once a year, my husband and I choose a month to practice financial fasting. Fasting is to willingly abstain from something… and we practice financial fasting to intentionally work toward not spending extra money.

Here are a few of the things we do:

We go through all our stockpiled foods and seek to use it up.

We focus on using our leftovers and digging deep into our freezer. We might work together to make a big batch of homemade waffles and freeze them. Our grocery bill decreases for the month, because we are using what we already have.

We choose all activities that are free for the month.

We visit the library for books, music, and movies. We go hiking and exploring. We make all our treats and snacks at home. On the weekend, we also pick family activities that complete a house project, like organizing the basement or raking leaves.

We use up all our free toiletry samples.

We go through our cupboards and make sure nothing has been sitting unused. If it has been sitting idle, we put it to use. We also go through drawers and use up any idle cleaning supplies, candles, or craft supplies.

We organize our house.

We gather anything for donation and take it to one of our local secondhand stores. Anything not in use, but worthwhile, we might sell or give to someone who can use it.

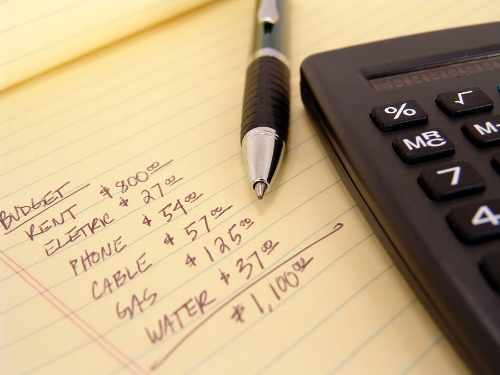

My husband and I have a family finance meeting.

We gather all our monthly bills and review their costs. We cancel anything that is unnecessary, and adjust anything that we are paying too much for. Doing this on a regular basis ensures that we are not missing anything that might waste our resources.

We do without.

If we run out of something in that month, before we purchase a replacement, we ask if can do without it or wait until the month is completed. For example, if we run out of lined paper, can I use the back of old documents for writing or drawing? Is there a homemade version we can make to replace what is out? Can I take time to mend or repair something that is broken?

We gather all our loose change and deposit it into our family giving bank.

When the bank is full, we choose where and for what cause to send our money.

A financial fasting month does not mean you won’t spend any money. It just provides an opportunity to be very intentional about what money you do use.

This intentional time also allows you to use the resources you already have and might have forgotten about. We find these months to be beneficial because it helps our family be intentional in everyday life throughout the year.

Lisa is a freelance writer from Holland, Michigan. She blogs about placing yourself in the proximity of renewal at About Proximity. She works with the Global Team of 200 of the organization Mom Bloggers for Social Good. Her favorite thing is to encourage others. She laughs daily with her husband, and kids Ellie and Josiah.

Great insight. I believe a Financial fasting us possible but a a person would have to plan things ahead and stop spending on unnecessary things. Also I am not sure where this person is from who was the guest post. I know in Louisiana where I live it is a struggle to save money and fast from spending. Everything is going up. Great article.

Love doing this even though I rarely make it the whole month :(. I’m a spender and I have started only allowing myself to spend money every third day. I found that eliminates a lot of Starbucks and eating out. I recently went two weeks without access to any of my money because of fraudulent purchases on my card and my bank account looked amazing at the end of those two weeks lol. It’s easy to overlook how much those small purchases add up.

We decided once to take a family challenge for two weeks called “no food in the trash”. Because the kids are highly competitive, they were all in. It was amazing how many ways they could come up with to use up food leftovers. We used half the money we saved from the grocery budget to buy a DVD the kids wanted and gave half to a food pantry. They learned how to save $$ , how to be creative, how to appreciate what they have, and how to help others. Whenever we get lax and start wasting food, one of the kids will call for a “no food in the trash” week and the competition is on. 🙂

I plan ahead, take inventory, make menu’s, check upcoming events…..then I shop only once a month with the exception of a few item such as milk. This saves me a lot of money & stress.

I too only get paid once a month and by the end of the month I am realm struggling. I hope to try this in the fall. If you or your spouse is a hunter then that is a good time to use up stockpiles from the freezer to make room for fresh meats also if you grow a garden and you can see through doing this twice a year spring would be another good time to do this as to use up any veggies from the year before that may still be in your cabinet or freezer so you again have room for fresh. I have always been one of those people if I have it spend it so this is defiantly going to be a challenge but one I want to really try to do.

I really enjoyed reading this post. We had just started doing this without calling it a financial fast. We have a couple reasons: we spent way too much on my daughter’s 18th birthday party this past weekend, and we just put a contract in on another home so we need to start using up what we have on hand so we have less to move. We are hosting Thanksgiving (the move will be after that!) and we have even made a menu using things we already have in the freezer. We have had that turkey for several months!

Another point of your financial fast also fits in well with our possible move–organization. Organize, pack up and donate.

Thanks for a great post!

This is such a great idea! It’d be so interesting to see how much could be cut out of the monthly budget just by using what’s already around!

I honestly am in the process of writing a post like this about mine and my husband’s “No Spend” months. Twice a year I get 3 paychecks in a month instead of 2 (since I get paid every 2 weeks). The month that happens we plan ahead to eat out of our pantry, spend no money outside of absolute necessities and use the money we save to pay off a debt (we’re working the Dave Ramsey plan at an adjusted pace) and/or build our emergency fund. This month is the 2nd time we’re doing it and it’s easier than the first time, so I imagine it will only get easier the more we practice. 🙂

Great idea!

I too love this idea!

I think January is the perfect month. The holidays are over. We all have new things to enjoy. It is cold and icky for driving in my area too. More reasons to find things to do at home instead of going out.

I like the idea of taking the budgeted amounts out but putting them somewhere and using them the month after. I think I would still have to stock up on some of the deals for the month as somethings are not on sale very often and my stockpile depends on these sale items.

The other thing that struck me was the extra mortage payment. WOW. Just think if you could make 2 in a year. I may have to add this to my lsit of goals for the new year for my finances. I want to prioritize my budget and save for a kitchen remodel!

I agree January is the perfect time-I feel like we get so much new clothes for kids, toys, have leftovers, cookies etc. EXCESS EVERYTHING! I always use the 1st week of January to purge closets, clean out the fridge and freezer etc. I feel like we also have to since we spent so much on the holidays it is a way to get back on track. Start the year fresh with a little extra money towards goals, getting back to the budget, cleaning out the cabinets of food and dust-once I take down the holiday decorations I just want to start fresh and this is a great way. Great post!!!

I think we’d come up with a number of things we could regularly do to save money if we spent a month working on it. I think we’d be really surprised at how much we can actually do without and never end up replacing.

I like to use up my stockpiled food in the spring, since we have random holiday foods left we wouldn’t use in the summer–pumpkin bars in June seems strange. It helps give me a good idea of what I stockpile because we actually use and what I stockpile because I THINK we use it.

Love this post! I often wonder how great it would be to not spend any money for just one pay period (other than fixed bills.) I have never planned to make it a reality. Maybe it can be a dream come true and the whole family can “play” along. It would hopefully develop some good habits like you said.

I love all your additional suggestions. This website and its community is a treasure trove of very wise ladies 🙂

This is a great idea. I have heard of this concept before. My husband and I do something like it, although not necessarily because we choose to. Since he is a teacher we only get a paycheck once a month (ouch!) so usually the last week we are really short. Some months, due to unexpected expenses like car repair or medical copays, we have less to really spend on which is when the freezer meals get used and the food in our pantry really gets depleted. I am thankful that I shop smart so that we are able to restock when money is available for those times. I try not to be wasteful anyway, but I end up going through my house about every month to see what we can give and even shop in my pantry for food donations – striving to live a simpler life is ongoing!

I love that this idea isn’t based on a financial emergency but on a time of wisdom and refreshing. I had my husband read it too and we want to start implementing it into our year or even try one week a month not spending on our cash budgeting system.

LOVE this idea and I agree with some of the others….this is one of my all time favorite posts. I could really get into doing a financial fast this winter and I’m pretty sure my hubby would be on board. 🙂 Thanks so much for sharing!

I love this. My husband and I are getting back to budgeting. We have been blessed, but I find that whatever money we have we spend. I want to get back to being more mindful about how I spend my money. For example, if I work an hour of overtime, great, but that doesn’t mean I have to spend it.

Such great suggestions!

Do you find that this results in a higher than normal bill for the following month? I tried something similar to this for my grocery budget a few months ago, and while it was helpful in some ways, I was very close to going OVER my grocery budget the next month because my stockpile was depleted, I was out of staples, and I started the month off with much less food in the fridge/pantry than normal. Of course, it was still helpful in forcing me to re-evaluate what I really needed, but it seemed almost too extreme since it made the following month quite difficult.

I could see this as a problem with grocery budget for the next month. For us, I liked the benefits of using what had before it went to waste. But, that is surely something to consider before trying a month like this.

Or if you are concerned about depleting stockpiles, you could always not factor food into the equation and work on other financial area- like Andista’s comment that she focuses on just gas some months.

I had wondered this too. I’d really like to try doing this in January – after all, what easier time to go without buying new things than right after the holidays, when we probably have lots of leftovers and just got a couple of new things anyway?

Since this would be new for us, and I’m a little nervous, my plan was to still take out the cash that we would normally use on groceries and set it aside, and wait and see how it goes in February. My goal would be to also make it through February without using the $ from January, but I think it would make me feel better to have a little cushion, if that makes sense. Then, if I can make it through February and stay on track, then I can have the extra $ from January’s food budget to either give away, or make an extra payment toward our mortgage!

That is a great idea to use the extra to make a mortgage payment. I just read the Automatic Millionaire by David Bach- and read that if you make 1 extra payment on your mortgage a year- you will knock off 7 years off of a 30 year mortgage. Bankrate.com will also show you that too. Otherwise, if you get your tax refund and make an extra payment- you can also pay off your mortgage 7 years early. Just thought that was neat and would share!

Great idea! Just be sure your lender applies the extra payment to the principle.

Thanks for sharing this comment!

If possible, would it be better to rotate through what you have every month or every other month instead of clearing it all out? We’re already really tight with our budget, but I like the idea of clearing out the freezer and pantry of items that are near or out of date. I recently cleared my pantry of out of date items and used many of them with excellent results. After the fact, I actually felt like there was no need to get rid of or use many of them, since they were better than fine. That worked with most of the items. One or two things it was obvious when they were opened that they were past usability. That helped me know what things last well beyond their expiration/best by date.

I do appreciate your other ideas, too. We already do free activities. We LOVE our library! We do without, quite often. The finance meeting happens about 3 or 4 times a year for us. Our change is already allotted. Right now, the house organizing is a constant challenge. I appreciate how you describe your process for that. I’ll check with my hubby and see if we can do that, too.

I would take this view of things. It’s a great idea, but I find that I stress out of the lessed stockpile later. I would rather have a low amount (like $300) for pure necessities for a month and then just shop at stores that only sell food, like Aldi or Trader Joes. It’s a challenge, but I’m not scrounging.

Yes I have found this to be the case. For example, I order allot of my dry goods and toiletries from amazon prime. In June, a big birthday month for us, I decided to not place my usual $100 order. Now this month when i went to organize my order, I am way over budget and not coming out ahead. Not sure how I can make this work. I guess I can make it work within my usual budget and just do without is my next step.

Take stock and use your older items. Only buy essentials like milk. And if there are good loss leaders you can use, go ahead and get them. This is about re-evaluating.(Maybe even set a budget for the possibility.ex- I know in late Aug/early Sep we go pick apples at an orchard to can.) Do what works for you. Just spend as little as possible. Write everything down and it’s not the time to try new or frivolous things. You might be able to work with a buddy and pool your supplies together.

We are pretty cognizant of our spending all the time, but something related that I try to do on occasion is go on a ‘gas fast’. Before I go anywhere, I stop and ask myself “is this trip necessary? Is it possible to wait and run this errand when I have to go to X on that side of town anyway”??

With gas prices the way they are, this is another great way to save money!

Amen! I am there. Sometimes we just go and do because we can…then worry about it later. I’m trying to be more mindful about gas spending as well.

LOVE this post! What a great idea!

Absolutely one of my top fave posts! Thanks for sharing your wisdom –

A perfect time to do this is now, especially with the holidays coming up! Great post!

Oh this sounds like something hubby and I might try every other month next year! I could see where this would come in handy around birthdays and the month the baby is born. We won’t be going anywhere and we are working hard to stockpile for the new baby! I bet he would be on board with this since he doesn’t spend money anyway lol!

The months of a new baby would be a perfect time! How exciting 🙂

Yes, I also like to do this during school breaks, since the thought of dragging all to the store is killer! The ideas listed here are also great to use regularly when you really want to chip away at debt.

This is one of my favorite posts I have ever read. It’s something I’ve only recently started doing, and I love some of the ideas you’ve given me that I can use to expand on what we’ve already been doing. I especially love the donation of loose coins.

This was a wonderful read. I love the idea of spending/not spending being so intentional.

We had to get intentional 🙂 We found that we could just not get it together.

We had great intentions but following through was super difficult for us. Every month was like crash and burn for us.

Taking this time made it a family effort and helped us slowly learn to apply it to our daily lives.

I love this idea! What advice would you give to a family that wanted to try financial fasting for the first time? Like making waffles ahead of time and freezing them, are there any other things that you do, maybe the month before, to prepare for a month of financial fasting?

Thanks!

I’m sure the blogger will have much better ideas as I’ve only recently started doing this, but I have started freezer-cooking on a semi-regular basis recently. So, I will use those meals made up from prior months, and I will also try to use what is just in my pantry to make another freezer meal. Usually, it is very, very simple, such as homemade chicken broth made from a frozen chicken and frozen veggies (I toss end of celery, extra onion I won’t use, etc. in a bag to use for stock or soup). For some reason, during my month of financial fasting, I feel super excited about certain deals, like the recent free 8×10 photo from Walgreens! 🙂

The only other piece of advice I would give you is to have a realistic idea of how much you’re currently spending before you start your financial fast. While you will certainly learn as you go, it’s easy to become defeated (at least for me) when I see how much the bare-minimum spending it for gas, home insurance, car insurance, etc.

Best of luck to you!

I agree with your feelings of defeat when seeing how much just the basics cost. When looking at the gas and electric bill, I feel there are just so many lights I can turn off and can only turn the heat so low.

Meagan-

That’s a great idea to prepare beforehand. The main thing we do is pick a month that is not already super busy. We usually choose a month in the winter because we live in a snowy area. It’s easier to commit to that when other things are not pressing for our time.

We were just struggling with being consistent. We found that focusing a month on that, helped us get organized and be able to do those little things like making waffles ahead of time. Learning how to incorporate that into our everyday life helped us do it through the rest of the year. Revisiting each year helped us refine the process and keep improving.

I am sure many of you are more advanced at money saving, so I imagine preparing ahead of time would help you go even deeper in your fasting month 🙂 For us, the first time we learned as as went and it was not necessarily smooth. Preparing I think would help the days move more smoothly!

Thanks so much for the advice! We are saving up for a house and just need to buckle down this winter to get that last little bit ready for our down payment. Will definitely be trying this out. Great post!

We do our financial fast in February. It is a short month and relatively low key. Our local college does a Valentine’s dance complete with a live big band which we absolutely love. So we do that. But still, the idea is to cut back and reevaluate what is going on financially with your family.

I plan to do one in Feb, and then again in June and Oct. I’m saving for a used car (no car payments, paid 100% by cash) so I can use these spending fasts as a jump start to add more money to my savings account above my monthly budgeted amount. 🙂

Wow, this is such a great idea! I like trying to focus in for a month…they are things that I try to do off and on as needed but often forget. A month is a good amount of time to tackle some issues at every angle. Thanks!

That was us, best intentions but always forgetting 🙂