Julie emailed in the following tip:

My husband has always been a cash user, and only uses other forms of payment when necessary. As for myself, I still have a debit card, but I try to use cash for most of my purchases.

Using cash has allowed us to implement a simple savings plan (my husband’s brilliant idea) that has helped us purchase a number of big ticket items in our household, including our computer, camera, and dining table.

What is this savings plan you ask? It’s simple… don’t spend your $5 bills.

I realize a five-dollar bill seems like a rather large bill to just stop using, but when you’re using the cash system, you may find that you don’t notice it as much. (Except for the occasional time you have to break a $20 and get three $5’s in return, and — oh yes! — it happens.) When this does happen, just close your eyes, put those $5 bills in your jar and move on. Before you know it, you’ll be able to purchase that item you’ve been waiting for!

If you just can’t force yourself to give up those $5 bills (or you’re in a financial position where every penny matters), start out with $1 bills or even quarters. Instead of spending them, stick them in a jar and save them. Before long, they will really start to add up!

For more money-saving tips, check out Julie’s blog, MeagerMom.com.

We save all of our change, and put it in our girls’ piggy banks. Once a year, we roll it up and deposit it into their bank accounts (which they do not know they have). We also put all of their monetary gifts from birthdays and Christmas into these accounts as well.

When they graduate from high school, they can then use the money for additional college savings, or for whatever they choose. It’s a great way to save for their future, and we don’t even know we are!

A friend of mine used to save her $10 bills, and it worked fine. But when she switched to saving her $5 bills, she actually found that she saved more–enough to pay for a vacation one year! She says you get more fives than tens when you get change, so they add up faster.

Thanks for this post….it’s a great reminder to me to start doing this!!

My husband and I have been doing this for a few months with our $10 bills and adding it to our regular savings account, it has doubled our savings in that short time. It’s has saved us from buying random impulse purchases because of the “gamble” of it costing us $10 more than sticker price. 😉

Great advice! I may have to start with $1 bills…but this really motivates me!

My husband works for tips and we use only cash. We have a big water jug and we put all our change and $2 bills in it. Plus, when he makes more than expected we throw a $20 in there. When it is full, we use it to pay toward the debt we are paying off. when full it is a couple thousand dollars! And we don’t even miss the money!

We have done this for years. Only rolling and counting one time a year (usually in July). We then used this money to make an extra payment on house, business loan, what ever was owed on. We are now debt free!!(When I say debt free I mean we owe no man) Our daughters save their change too. We would sit a roll and talk about what they wanted to put their money towards. I would help, if I could at the time, round it up to help them meet their goals. It is soo satisfying at this point in our lives to be debt free. Now I look around the house and wish we had not spent on little this and thats and had that extra money in hand. It is all a mind set, that each of us have a decide what is right.

We helped pay for our wedding by not spending our change. We collected the change in a jar and after we had several dollars worth, opened up a joint savings account (back when you still earned interest that mattered). Every few weeks we would make another deposit.

My parents did a modified approach and saved all of their pennies and nickels to help save for college for me and my brothers.

It is amazing how you don’t ‘miss’ it and amazing how quickly it can accumulate.

My husband and I have been doing this with our change for 3 years and have been able to use it to pay for 2 (low budget) vacations!

My husband and I started doing this in February 1 and decided we would do it until June 1 to see what we could save. We agreed all roll-able change and $5 would be what is deposited. We have one month left and have saved a few dollars short of $700 in just the 4 months so far. We did not go out of our way to get $5 bills either.

We are missionaries and live overseas so the money is obviously different, but for the last four years I’ve been saving my coins…not all of the tiny ones because I can’t run to the bank to turn them in, so it is best to actually spend those…but we save the big coins (ones that are the equivalent of about 50 cents and 1 dollar). I purchased a rug for our dining room last year with those, and I am currently halfway towards my goal this year for a new shelf! It feels like free money. 🙂 My mom has been saving her coins for years, and she gets quite a bit just with the coins. Last year with her coins last year she bought two new arm chairs for their study. It seems to take awhile, but it does add up!

When DH and I first married I waited tables and I would save my one dollar bills that would not go into big bills. I would also take one twenty a pay check and put it into an envelope under my spare tire in my car. I don’t recommend doing this and telling anyone. Now two years of this I never had to change my car tire so I never looked under the lid that hid the tire from site. Out of site out of mind. I know how foolish this sounds but it came in handy for us. My DH has to remind me to go and get the envelopes twice a year but that money has come in handy over the years. Emergency tow, Bad weather stays in hotels while we were traveling, new tires, and a few other things. It has been 15 years and I am still doing this. The hiding place has changed over the years though. It works for us. I also save my quarters in Mini M&M tube and stash them in and around my Van.

I have paid with bills and saved change for years. The change always goes for something extra that we would not normally buy- a video camera, a digital camera, fruit trees, etc. Right now I am saving my change to invest in note cards to sell- using some of my daughter’s photos- http://www.photosbyamelia.blogspot.com.

Love this! I can always remember my Dad saving quarters – he would “buy” them off you. In fact my parents funded many a trips to Hawaii and Alaska on quarters! Talk about incentive…

We started saving for our house using our change and a $5 direct deposit from Hubby’s check. We are now at about 30% of our goal. Even the little amounts saved consistently will add up!

ok i really like this idea!!! it is fun and creative

I have been saving my 1 dollar bills for a few years now, never thought to save the 5 dollar bills. Great idea, I`m going to try it.

We started this 5 minutes ago (just after reading this post) – Excited to see how much “free cash” we will have for our annual LA trip to see friends and family in June!

http://theeducationofadri.blogspot.com/2012/05/save-your-5-bills-we-are.html

oh and p.s. we don’t use an envelope system (gasp!) so this will be a fun way for us to compile spare cash into one place as fun money!

My mom, who is NOT a good saver or money manager at all, did this and saved about 1500 dollars in about 9 months to start college funds for her two new grandchildren. Now I think after she got going and was excited she actively sought out 5’s to help the money grow faster. Still, I think this is a great easy, simple saving strategy for anyone.

I worked as bank teller for a while, and all I can say is that at the time it drove me crazy when people came in with huge amounts of change. No, the extra work didn’t bother me, but the waste did. At the time the interest rate on a free savings account was 5%! People would tell me they’d been saving for years and all I could think about was the interest income they hadn’t received. With interest rates what they are now, though, I guess it’s a moot point!

My father in law saves his change all year long in a huge jug and gives it to my two boys for Christmas. There is always more than $300 dollars in the jug, and we use it to offset their preschool cost. I love what this teaches them about saving/experiences over toys they will forget.

We did something similar to this, but we saved back our dimes and put them in a really beautiful glass jar we found. When the jar is full we intend to cash it in and go on a mini vacation.

We save our change to pay for an anniversary trip every year. This October will be our 5th one!

My question is, though, aren’t you essentially taking categorized money (if you use envelopes) and taking out small bits and putting them in a slush fund this way? If you truly have your envelope system tweaked and don’t have 5 dollars wiggle room in any of them (or don’t want to, for example, have less food money because you want enough for good produce) why use this method? I’m not trying to be critical but I don’t understand the value of this if your budget categories are already tight.

I wondered this as well. Another poster mentioned the “psychological tricks” we use to try save money. Instead of using these “tricks” I personally have found it better to just work on self-control and keep my spending in check. Our savings account has a very healthy balance as a result.

I think this would maybe be for folks not on a strict envelope system?! I have been doing this with singles and change but it takes us awhile because we don’t end up with alot of “spare” change. I recently started doing this with larger bills 20s and 100s. I rarely go to the bank so it is unlikely that I ever get around to depositing windfalls of cash (christmas gift, anniversary present, someone reimbursing us with cash for an item we had already paid for.) This money could be placed in a savings account but it is rewarding to see it build up and to have it just in case something comes up. Plus for me it is a visual reminder of how a savings account should work. Once I put the bills in a jar it is really difficult to spend it frivolously this goes the same for our savings accounts. So I don’t add from my budget but from those extras that come my way.

We fit this category and if you see my post below we have save $700 in $5 bills and roll-able change only. We simply do with less in our envelopes. That was part of the challenge. See if we can do it without having to subsidize the envelope. We did make 1 essential tweak, Hubby was out of gas money each week but I just took from mine and gave to his because my schedule got lighter with sports ending. We buy less groceries but this meant less snack foods really. We have slightly less blow money but really it’s fine. It’s a fun challenge we’re actually enjoying the constant “game” it seems to create because it’s different every week.

Diane,

Our budget is very tight too. I need my money in my enevelopes! However, at the end of the month I take any change in any of the envelopes and put it in the jar. Then I feel like I am “saving or it’s extra money.”

And since Jan. I have had a surplus in our grocery budget but instead of rolling the money to the next month I am keeping it seperate. I am thinking we will use the extra grocery money to either buy meat on sale to stock pile or even use it for buying a 1/2 cow or pig since there’s no money in the budget for that.

I saw this on Pinterest a few months ago and starting saving my fives. I’m up to over $600. It’s been fun. I get excited when I give a cashier a $20 and she gives me back three $5 bills.

Filing this idea away for someday down the road!

Right now, I don’t spend change. I use it to give my kids an allowance. Our budget is really tight, but we think it’s important for them to learn to be responsible for money too. So I just put all my change in a basket and pay them from it.

Me too!

We do this with our coins we get back from purchases. We don’t spend them & about 2 times a year we have a mini vacation such as a roller coaster theme park or a night in a hotel with a pool so my daughter can swim in the winter!

I was raised by depression era parents. They taught me to save/stockpile – whether it is food or money.

I do this with quarters. OK, I know that’s not like putting $5. bill aside, but still…

I call it my mad money. I also take one $20. bill and put it away each time I visit the ATM for my cash. I clip them together in $100.00 bundles. I have cash on hand (in a safe) in case we need it quickly. Banks don’t function when working people need to get in.

We have 2 banks one for quarters and one for dimes pennies and nickels.. I wait until they are full and take them to c.u. and use the machine{for free} and that goes into our savings we use the envelope system and just add this to the little bit we manage to save it really does add up but it makes you feel good about saving more so you can pay cash for the things you need instead of debt.. We are almost retired and about 10 years ago we stopped using credit, due to large hosp.bills we have not saved as much as we would have liked to but we have no debt and we live very frugaly and its fun, I would just encourage you young people out there with children to save a little it doesnt have to be alot and learn to raise your children so they see you work for what you get…this is a great life our heavenly father gifted us with and I encourage all of you to dont be discouraged just do what you can and be proud of your self..its hard when you see people who have so much but rememeber the people who look like they are doing well arnt always sometimes they are just deep in debt… just be proud of what you can do and of yourself for your effort…god bless you for trying dont give up….

How encouraging! Thank you! God Bless.

I love this idea.

I recently saved all my $5 Target giftcards and bought a new knife set. It only took a month or so.

My mother in law did this for a few months before they went on vacation and had over $200 in spending money. It works really well.

This is such a great idea! I need to get back to my cash envelope system, and when I do, I am going to start doing this. We usually save all of our change for our change bucket. Our bucket full holds about $100. Helped us pay for our upcoming Disneyland trip.

I try to save my change and when the jar gets partially full I put it into savings. I don’t think the $5 trick would work for me. Some of my envelopes only get $5 per paycheck. I have a created a really tight cash budget….so there is not much left to squeeze out. I think that saving $1 bills would be a little tough for me!

What a great idea! I imagine it would even work with pennies. It would take much longer, of course, but the concept is the same.

We take our annual trip to Hershey Park every year using the years change. Usually we collect around $300-400 per year in change. If we don’t use that much for the HP trip we use it for spending money on another family trip. That, and our holiday/gift savings account, are two of the smartest (and fun) things we’ve done with our money 🙂

Our household is saving all of our change for our trip to Disney this September. We told our 3 kids that the change will be their souviner money when we go. We started saving change on New Years Day and we counted it yesterday and they have already saved $85 🙂

Melissa here’s a quick trip for your Disney trip. We just got back from there. There are several Walmarts very close to Disney and they have an entire Disney souviner section!!! It’s the EXACT manufactuer that makes the product for Disney but at a fraction of the cost for Walmart. Here are some examples: Disney t-shirt with characters for kids $19.99+ Disney, Walmart same shirt $8. Disney pins start at $8 and go up at Disney, Walmart $5. We got lanards to wear to hold the park pass’s and fast pass’s and they were only $3.97 at Walmart. I got one and just held everyone’s pass. It just depends on the age of your kids if you will be seperated or not if you wanted them to have their own. Also at Disney they sell fan spray water bottles but cost $18 you can get one at walmart for $5 or what we did was get a spray bottle at the Dollar Tree for $1. Also the Dollar tree was great for glow sticks, necklace’s and bracelets for the nighttime parades or fireworks!! Also stuffed animals are much cheaper. Mickey and Minnie were $21 at D but $10 at Walmart.

Anyway didn’t mean to highjack the post. Just thought this might help.

Marie, I went even cheaper when we visited Disney. We had our trip planned for several months beforehand, so I kept an eye out at thrift stores for Disney t-shirts and trinkets. I had a t-shirt and stuffed Disney toy for each child, as well as a couple of cups and keychains, that I secretly packed in my suitcase and gave to them after our first day at the park.

When we were at the park and they wanted to buy things, I told them that I’d already purchased them some surprises and that they were sent back to our hotel. My kids were completely satisfied with their “souvenirs”, and I paid a whopping $7 for all of it.

I’m not sure how well this would work with older kids, but mine never even noticed a lack of price tags, or that the shirts were second-hand.

Also, check out couponingtodisney.com she has TONS of suggestions for Disney. I live in Orlando so have been to Disney too many times to count and still didn’t even know about some of the restaurants and other things she posts!

My change, money from pop can deposit and Ebate checks are all going into my piggy bank for our Disney fund. Not planning to go for a year or two, but already my pig is getting heavy!!

I save all my change for different things. It might seem weird but I save all nickles and pennies to stock up on stuff the kids will need for school like new socks and undies. I save quarters and dimes for birthday gifts. I keep them in empty pill bottles and each bottle holds $10 in quarters perfectly.

We have four different containers where we save change — all for different goals.

I have been reading Face book too much. I was looking for the “like” button on all of these comments. What an encouragement that even in the tough times we can still save something!

I often wish we could “like” these comments too!!

I always count exact change, I don’t know why not. To me it’s not really saving money to not count it or save up the coins because I’d be spending more bills. We do cash envelopes, too, but our categories are really close to what we need and if we said we are only going to have 40 dollars this month for gas instead of 50 (if we had two fives) we really wouldn’t have gas the last week of the month. So I guess my method is just to be up front with myself with what I’m saving and spending in each category and I really am happy with our family’s budget and the amount we’re saving.

Huh, this is a really great tip! I never thought of that but it will increase your savings. Great idea. 🙂

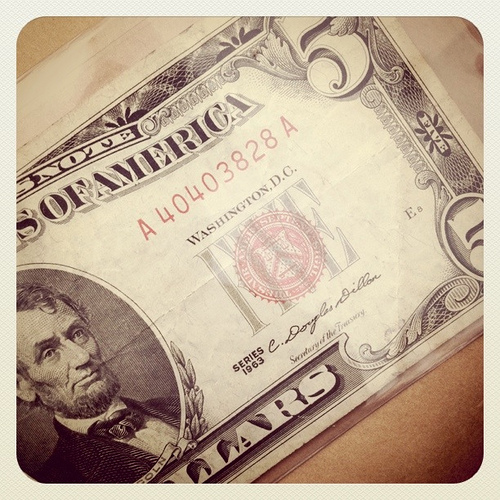

That Red Seal $5 bill in the picture is actually worth a pretty penny itself!

it’s been in circulation and even folded (you can see the crease) so it would only be worth $7-$10. uncirculated perfect condition red seals can go for around $30 (which is still more than just $5!). 😉

Don’t you have to pay 8% for Coin Star?

Not if you get a gift card instead, like Amazon.

If you have an account at a bank or credit union they will usually count it for you for free if you deposit it.

My bank counts it for free for account holders and I don’t have to deposit it.

Or you can roll them yourself. We’ve done it for over $600 before. I enjoy sorting/counting change and my husband enjoys rolling though.

Our bank has a counting machine for free – as long as you cash it in there or deposit it in your account! Before that we rolled our own (the bank gave us wrappers to take home). We’ve used the coin star ones for resteraunt gift cards for use when we travel or amazon cards. I’d check with your bank though – they usually have them now to save everyone time and money.

Lea

A lot of interesting psychological tricks to try on yourself. Thanks.

Our change goes into a money jar that I empty out every few months to get my hair colored and cut 🙂

I’d love to try this with 1s but don’t know if I can afford it right now.

I don’t spend ANY change anymore. I used to be the annoying person as the register that would count out 96cents. if I had it. Now even if it is $6.01, I will not give the penny, the reason I save all the change. Doing this has allowed me to save up to $40 a week, depending on the week!

Ha ha… Hi, my name is Sarah, and I am that annoying person. I never empty the change from my purse, and then pay for incidentals (like a churro at Costco) with it.

We’ve always saved our change for “fun” purchases. When I started using a debit card, I really missed saving change. But my bank has a program called Keep The Change where they round up your purchase and put the difference in your savings account. It’s not quite as fun as saving money in a jar but it’s still fun – and painless.

Couldnt do it with the $5’s but I might try this month with the $1’s, if that wouldnt work out I can easily continue doing so with all my change. 😀

I couldn’t do the 1’s. Our Aldi gives me back only ones.

I’ve never done that with bills, but I never spend my change (even if the total is $2.01. I still use bills. Then throw the change into a huge jug. Last year we turned in over $1,500 in change (the teller thought we were nuts). But we paid “change” for a brand new stove and camera. 🙂

that was a Hot Tip in the May issue of Reader’s Digest, too. It said one guy saved $12K in 3 years!

It’s an interesting idea! I’m not sure if I’m ready to stop spending my $5’s, but we’ve gone through long periods where we empty out all of our change every night into a jar. Sometimes it’d be a couple of pennies, sometimes a couple of dollars worth – or even nothing on the days where we didn’t spend anything! But over time, it added up really fast without being too painful. We have cashed in our change jars for over $100 before!

My Mom has always done this with dimes. For years and years and years she has collected dimes and boy has it come in handy during tough times with having all those dimes lying around and being able to cash them in.

My uncle does this, too. I love seeing the dime jar when I go to visit, reminds me of being a little girl and trying to guess how much was in it.

My aunt also does this. She uses a water cooler bottle (5 gallon!) to keep all her spare change.

One thing I have done for years is when I write checks, or have an auto pay bill come out, I always round up. For example

Water Bill 19.70, in my banking ledger, I’d put the withdrawl for 20.00. At the end of the month, I move the “round up change” into our savings account.

On our budget, we already do all change, and ones only when we have a bunch of them, but we’ve been able to buy a lot of the things we’ve needed that way. We also add in recycled bottle money and any small money gifts that we get 🙂

Ive been doin this for a while. Saved for a couple months and completely paid for a trip to Vegas. Even came back with cash left over. It’s hard at first, and for me was even harder because I don’t use cash much. But once you start, and see it stacking up, it makes it easier!

I bet if I put all coins and ones in a jar it would add up fast. 🙂

This is a neat idea.Thanks for the encouragement!

Wow, that’s an awesome tip! I’ve been putting away $20 from my budget every week. All my spare change goes into a jar, and yet I still feel like I’m crawling towards my goal. I will try this method, thanks!

It does add up very quickly, we did one month were we just “ignored” our coins and dollar bills, at the end of the month we had over 50 dollars in our little jar.